In this study, we will address two types of the transactions with debts:

- Acquiring a debt arising from various obligations, and then receiving the payment from the debtors (both UAE-residents and non-residents).

- Collecting debt in the interests of clients, receiving payments from debtors and transferring them to the clients apart from remuneration due.

Further, the first scenario will be referred as the “simple debt purchase” and the second as “factoring services” or “debt recovery services”.

Continue reading here or download the PDF

VAT on debt recovery services

1. The operations with debts do not imply the supply of goods by the Company. According to the Article 1 of the VAT Law the services are defined as “anything that can be supplied other than Goods”. Therefore, the company’s activity may be treated as services.

Such treatment is obvious for the debt recovery services where the Company:

- has client to whom the services are provided, and

- obtains consideration (fees) for these services of collections.

Section 4.3.12 of the FTA’s Financial Services VAT Guide No. VATGFS1 sets forth that ‘Debt recovery and litigation Services related to debt recovery, litigation and the management of the recovery of debts due from debtors are subject to VAT at the standard rate. This includes all services related to debt factoring’.

Therefore, the debt recovery services are subject to VAT.

2. The place of supply for the factoring services ‘by default’ is ‘the Place of Residence of the Supplier’. We assumed that the Company has no establishments outside of the UAE. Therefore, the place of supply is in the UAE.

Among the special rules to determine the Place of Supply the applicable one is those from Art. 30(1) of VAT Law. It prescribes to treat ‘Place of Residence of the Recipient of Services’ as a place of supply ‘where the Recipient of Services has a Place of Residence in an Implementing State’.

‘Currently, the UAE does not recognise any other state as an “Implementing State” for the purposes of VAT. Consequently, the … condition … that the recipient of services should not have a place of residence in an Implementing State… will be satisfied if the recipient does not have a place of residence in the UAE’. VAT Public Clarification VATP019

Therefore, if both parties of the transactions has Place of Residence in the UAE, the place of residence is in the UAE under the special rule. If a recipient of the debt recovery services doesn’t have a Place of Residence in the UAE, there is no special rule to apply. Therefore, the Place of Supply for the services, provided by a UAE resident, is the UAE due to either default, or special rules.

3. Section 4.3.12 of the Financial Services VAT Guide includes factoring and other debt recovery services in the group of ‘Other financial services’.

Section 4.1.6 of this Guide sets out that ‘the supply of financial services to a recipient established outside the GCC (whether or not they would otherwise have been exempt where supplied in the GCC) will be zero-rated (i.e. they are treated as taxable supplies)’. This should be adjusted with general condition from Article 31(1)(a) of the VAT Executive Regulation: the recipient of the debt recovery shall ‘be outside the State at the time the Services are performed’.

Referring again to the FTA’s VAT Public Clarification VATP019, until the UAE recognize any other GCC state as an “Implementing State”, ‘the first condition for zero-rating (i.e. that the recipient of services should not have a place of residence in an Implementing State) will be satisfied if the recipient does not have a place of residence in the UAE’. Therefore, if the originator doesn’t have a place of residence in the UAE, 1st condition for zero-rating VAT is applicable to the debt recovery services. The considerations for the determine of the Place of Residence are addressed in the VAT Guide on B2B services.

Second condition to zero-rate this service is the originator’s location at the time when services are performed. We have also dwelled on this issue in the VAT Guide on B2B services.

Conclusions reached for consultancy services works for debt recovery services as well.

The principles to determine time when the services were provided are also considered in our VAT Guide on B2B services. The debt collection services are consumed ‘at the time of completion’ (i.e. when funds are received on behalf of the client). If at this moment the beneficiary of the services is outside of the UAE or has short-time presence in the State with no connection with the services, then this services shall be zero-rated.

Finally, even if the originator has Place of Residence in the UAE and (or) located in the UAE at the time the services are provided, the factor may still enjoy 0% VAT rate, if the services are actually performed outside of the UAE. This scenario has been addressed in the earlier Case Study Zero VAT and Short Term Presence.

Simple transfer of debt

4. In case of the simple transfer of debt, the Company acquires a debt arising from various obligations, and then receives the payment from the debtors.

In such scenarios, the Company doesn’t have both attributes of the taxable supply:

1) there is no client to whom the services are provided, and

2) the Company doesn’t obtain consideration (fees) for these services of collections.

Since the Company doesn’t supply anything, in literal meaning this activity of the company may not be described as “anything that can be supplied other than Goods”.

5. Article 8(1) of the VAT Executive Regulation specifies that ‘the supply of anything other than the supply of Goods shall be regarded as a supply of Services including any of the following: … the granting, assignment, cessation, or surrender of a right’.

This rule is rather applicable to treat the assignor (originator) as the supplier of the services, than assignee. The assignee is rather a buyer of the services who via collecting the underlying receivables consumes the purchased.

Article 1 of the VAT Law defines “Taxable Supply” as ‘a supply of Goods or Services for Consideration during the course of Business by any Person in the State, and does not include Exempt Supply’. Same Article defines “Consideration” as ‘all that is received or expected to be received for the supply of Goods or Services, whether in money or other acceptable forms of payment’. Again, assignor (originator) is the one who receives Consideration for an assignment of debt (right to receive it). The assignee receives money or other payment from the debtor. However, this is not a payment for any supply made by assignee. This is remuneration for what assignor supplied to the debtor.

6. However, such interpretation may be challenged by the FTA. The latter may:

1) treat the acquiring of the debt as true-factoring (also known as non-recourse factoring), and

2) treat discount (difference between face value of the debt and price paid for it by the assignee) as consideration.

7. We found no other clarifications or publication from the FTA or the UAE judicial authorities addressing this issue. Therefore, we examined international experience for the regulations with the same or similar wording.

8. Irish Tax and Service (Revenue) issued Tax and Duty Manual “VAT Treatment of Factoring and Invoice Discounting”. The Manual was last reviewed by the Revenue on April 2022

The manual addresses operations with debts applying the common VAT principles, regulations and case law of the European Union.

As per Revenue, factoring involves the assignment of a debt to a financier by the originator of the debt (the "client"), the giving of notice of such assignment to the debtor and collection of the debt by the financier.

As per Revenue, factoring involves the assignment of a debt to a financier by the originator of the debt (the "client"), the giving of notice of such assignment to the debtor and collection of the debt by the financier.

"Invoice discounting" also involves the assignment of a debt to a financier by the client but the client is responsible for the collection of debt as appointed agent of the financier.

In the situation at hand, the client doesn’t act as an agent collecting the assigned debt. Therefore, invoice discounting is out of scope of this research.

9. The Revenue’s clarifications hinges on the Ruling of the Court of Justice of the European Union (CJEU) in the MKG-Kraftfahrzeuge-Factory GmbH case No. C-305/01.

In this case, the Court considered “true factoring” which is ‘the purchase of debts with the full assumption of the risk of default’ by the debtor.

In this case, the Court considered “true factoring” which is ‘the purchase of debts with the full assumption of the risk of default’ by the debtor.

This was compared with "quasi-factoring" which was described in the CJEU Judgment as ‘where the client assigns to the factor debts owed to him arising from the supply of goods or services but remains fully liable in regard to the debtor’s ability to pay.’

In this case, MKG (factor) entered into both type of the factoring agreements with the client (originator).

In true factoring arrangement MKG agreed to purchase the debts assuming ‘the risk of default without a right of recourse against’ the originator. ‘The del credere ‘took effect if a dealer failed to pay the relevant invoice 150 days after it was due’.

In quasi-factoring arrangement MKG agreed under the contract to recover the remainder of the originator’s debts, but ‘with a right of recourse against it, and to manage the debtor accounts and provide’ the originator ‘with documents allowing it to ascertain the position with regard to its business relations with each debtor’.

The ruling of the CJEU concerns ‘only 'true' factoring — that is to say a transaction whereby the factor purchases from his client debts owed to him and assumes the risk of the debtors' default. The national court has no doubt, on the other hand, that 'quasi-factoring', where the factor manages and recovers the debts owed to his client but without bearing the related risk of loss falls within the field of application of the Sixth Directive’ , i.e. VAT-able.

10. In this case, the factor had to pay to the originator ‘the face value of the debts purchased by it …, less agreed charges… The agreed charges comprised

- factoring commission of 2% and

- a del credere fee of 1%

of the face value of the debts’.

The purchase price was transferred by the factor to the originator ‘only once the conditions of the del credere were satisfied (150 days after the invoice had in each case fallen due)’. Para 27.

The originator agreed to pay, in addition to those charges, interest calculated on the basis of the daily outstanding debit balance of the dealers with the factor. The interest rate was to be 1.8% above the average interest rate payable by MKG (the factor) in respect of refinancing.

The CJEU ruled:

- ‘First, where, as in such a case, the factor engages in true factoring by purchasing debts owed to his client without enjoying a right of recourse against the client if debtors default, he indisputably supplies a service to the client, consisting essentially in relieving him of the debt-recovery operations and of the risk of the debts not being paid.

- Second, in return for that service received by him, the client owes payment to the factor, corresponding to the difference between the face value of the debts which he has assigned to the factor and the amount which the factor pays him for the debts. It is clear … that, … Factoring KG retained, in accordance with the terms of the contract entered into with M-GmbH, factoring commission of 2% and a del credere fee of 1% of the face value of the debts purchased’.

It is not clear from cited extract should the judgement stay the same if the difference between the face value and price of the debt exists but without any commission concept introduced by the parties in the contract to justify this difference. In other words, weather conclusion marked bold are applicable to a case where parties used discount to face value instead of a commission fee.

There are arguments to justify mutually exclusive approaches to the question of the applicability of the rule to a simple discount:

1) the difference itself is enough to treat it as consideration for the debt collection services. It may either be split in commission(s) and named as fees or be hidden in a form of discount. Otherwise, there was no need for the Court to specifically mention this difference (the court may directly refer to the existence of fees/connisssions).

Furthermore, the Court first refers to this difference describing the consideration: ‘… in return for that service received by him, the client owes payment to the factor, corresponding to the difference …’. And then, the court specifies that presence of such difference is clear in this case as face value had been netted by the commissions.

This inclines in favor of the position that a discount to face value without commission should be also treated as the consideration for the service.

Above surmise may be substantiated with further reasoning in para 50 of the Ruling: ‘The making of such a payment therefore does not result from the mere fact that the debts are included amongst the factor's assets, but constitutes actual consideration for an economic activity engaged in by the factor, namely the services which he has provided to the client. There is thus a direct link between the factor's activity and the amount which he receives in return by way of payment, so that it cannot be maintained that a factor who engages in true factoring does not make a supply for consideration to the client and, therefore, that he does not pursue an economic activity…, but that he should be regarded as merely a recipient of assignments by the client of debts owed to him’.

- The reference to the payment is accompanied with ‘actual consideration’. The Court hereby stresses that ‘actual’ supersedes the ‘formal’.

Finally, the CJEU also ruled do disregard any distinction between the forms of debt collection: - the term 'factoring' ‘must be interpreted broadly, covering both true factoring and quasi-factoring, given that, as an exception to a rule derogating from the application of VAT, it must be understood as applying to all possible forms of that operation’;

- ‘… the term 'debt collection' must be interpreted as encompassing all forms of factoring. In accordance with its objective character, the essential aim of factoring is the recovery and collection of debts owed to a third party. Therefore, factoring must be regarded as constituting merely a variant of the more general concept of 'debt collection', whatever the manner in which it is carried out’.

Para 77.

2) the opposite approach hinges on the literal interpretation of the wording used by the CJEU:

a) ‘a business which purchases debts, assuming the risk of the debtors' default, and which, in return, invoices its clients in respect of commission, pursues’ a taxable economic activity;

b) ‘the answer to the second question submitted for a preliminary ruling must accordingly be that an economic activity by which a business purchases debts, assuming the risk of the debtors' default, and, in return, invoices its clients in respect of commission, constitutes 'debt collection and factoring' …and is therefore excluded from the exemption laid down by that provision’.

11. The choice between these 2 versions may be found by subsequent judgment of the CJEU in the GFKL Financial Services case. GFKL Financial Services case

The CJEU has examined this very same question in GFKL Financial Services, where a company (GFKL) purchased from a bank defaulted debts for a price below the debt's face value and assumed responsibility for debt recovery and the risk of loss.

The CJEU resolved this case with conclusion which is opposite to those made in MGC case and explained the difference in the approaches:

- In contrast to the facts of the dispute that gave rise to the judgment in MKG…, the assignee of the debts receives no consideration from the assignor, and therefore it does not carry out an economic activity within the meaning of Article 4 of the Sixth Directive or effect a supply of services within the meaning of Article 2(1) of that directive.

- It is true that there is a difference between the face value of the assigned debts and the purchase price of those debts. However, unlike the factoring commission and the del credere fee which, in the dispute that gave rise to the judgment in MKG…, were retained by the factor, this difference does not constitute, in the main proceedings, a payment intended to provide direct remuneration for a service supplied by the purchaser of the assigned debts.

- The difference between the face value of the assigned debts and the purchase price of those debts constitutes not the consideration for such a service, but a reflection of the actual economic value of the debts at the time of their assignment, which results from the fact that they are doubtful and from the increased risk of default of the debtors.

- In those circumstances, the answer to the first question is that … an operator who, at his own risk, purchases defaulted debts at a price below their face value does not effect a supply of services for consideration … and does not carry out an economic activity falling within the scope of … [VAT] when the difference between the face value of those debts and their purchase price reflects the actual economic value of the debts at the time of their assignment’.

12. VAT Committee of the European Commission The European Commission Directorate-General Taxation And Customs Union Indirect Taxation and Tax administration. gave its comments to both above judgements on 9 November 2017 in Working Paper No. 917. to the seller, as confirmed by the CJEU in MGK’ where those conditions are not met, i.e. where:

1) purchaser of a debt ‘assumes the risk of the debtors' default in exchange for a consideration (e.g. in the form of a specific commission’, or

2) the purchase price is lower than the face value of the debt ‘and this is not merely the result of the debt having a lower economic value).

13. The Irish Revenue also believes that ‘where a debt is simply assigned for its face value, or other value, to a third party without a factoring or similar arrangement, then such assignment will continue to be regarded as a VAT exempt transfer of, or dealing in, a debt.’

The Revenue illustrates it with example as follows.

‘Scenario 5 – Simple Transfer of Debt

An Irish-established Company A (the purchaser) purchases debts with a book value of €100,000 from an Irish-established Company B (the vendor). At this time, the market value of the debts is agreed to be €97,000 and the debts are purchased for such market value. Neither party raises an invoice for commission or other services.

Revenue response:

- The sale of the debts by Company B is VAT exempt.

- In keeping with the decision in the Hagemeyer and MKG cases, the activities of Company A do not fall to be regarded as taxable factoring services for VAT purposes as the arrangement is not governed by a factoring agreement and there is no consideration or fee received or payable to Company A. Accordingly, this will be regarded for VAT purposes as a simple debts transfer agreement’.

14. Therefore, simple transfer of the debt and subsequent collection of the receivables doesn’t constitute services unless both above mentioned conditions are met. Otherwise, the purchase shall be reclassified in the debt recovery services. VAT treatment of the reclassified is considered above.

15. There is no clarification on how tax base shall be calculated for the reclassified discount with no fees identified in the assignment. There are 2 versions:

- amount of discount to the book value (face value) shall be treated as fees; or

- actually collected amount shall be determined, credited with amount paid to the creditor and the difference ensued is subject to VAT.

Section 4.3.12 of the Financial Services VAT Guide cited above treats the factoring as debt recovery service. The recovery services may not be treated as provided unless the debt is recovered. Therefore, we believe that the factor’s taxable consideration is difference between collected amounts and amounts to be paid to the originator.

16. The date of taxable supply for a “discount reclassified in fees” is also not specified in VAT legislation. Hence, general rules shall be interpreted for the specifics of such operations.

Article 25 of the VAT Law determines that ‘tax shall be calculated on the date of supply of Goods or Services, which shall be the earliest of any of the following dates: …

(6) The date on which the provision of Services was completed.

(7) The date of receipt of payment or the date on which the Tax Invoice was issued’.

It seems reasonable, to refer to the cited rule of the Financial Service Guide where factoring is treated as ‘debt recovery and litigation Services related to debt recovery…’. Under this angle, arrangement where, economically, remuneration of a factor is an excess of what has been actually collected over what is to be paid to the originator, is similar to success fee arrangement in legal services. It is impossible to calculate consideration before the excess appears.

Therefore, we believe that service deserves consideration when the excess amount is collected. Its receipt may be treated as both completion of the collection services and payment thereto.

Reverse charge in operations with debts

17. Where a scenario at hand comprises the ‘assignment, cessation, or surrender of a right Article 8(1) of the VAT Executive Regulation’ by the client (assignor/originator), the Reverse Charge Mechanism (RCM) shall be considered.

The RCM is applicable where a non-resident supplier of goods or services which are treated as making a supply in the UAE. As a consequence, the non-resident may be required to register for VAT and charge UAE VAT. The RCM is a simplification measure to avoid the need for nonresident suppliers who are resident outside UAE to register for VAT when they make a supply of goods or services in the UAE to registered persons.

Furthermore, the RCM puts the recipient in the same position as they would have been if they acquired the goods or services from a domestic supplier, thereby ensuring that domestic UAE suppliers are not disadvantaged by VAT not being collected from purchases from abroad.

Where the reverse charge mechanism applies, the non-resident supplier will not charge VAT to the recipient. Instead, the recipient must self-account for the VAT in respect of the goods and services received. This means that the recipient must record the VAT on the acquisition as output tax at the applicable rate in their system and declare it in their VAT return.

This “self-accounted” VAT may be able to be recovered by the recipient as input tax in accordance with the normal input tax recovery rulesSection 7.4 of the Taxable Person Guide for VAT.

18. According to the VAT Returns User Guide, the value of imported services must be indicated in Box 3:

- ‘You should declare in Box 3 the value of supplies of goods and services received which are subject to VAT under the reverse charge mechanism.

- This includes imports of services where the customer is required to account for the VAT. Please disregard any imports of goods that have been declared to UAE customs during this Tax Period which are subject to the reverse charge and for which the import VAT is reported separately in Box 6.

- As a result, in most cases the values declared within this box will relate only to purchased services which are subject to the reverse charge mechanism.’

19. However, generally such recovery is not allowed for exempted operations. According to Art. 54(1) of VAT Law the Input Tax ‘paid for Goods and Services which are used or intended to be used for making any of the following:

a. Taxable Supplies.

b. Supplies that are made outside the State which would have been Taxable Supplies had they been made in the State.

c. Supplies specified in the Executive Regulation of this Decree-Law that are made outside the State, which would have been treated as exempt had they been made inside the State’.

So, generally, exempt supplies doesn’t authorize a taxpayer to recover input VAT (including self-accounted VAT in RCM) related to such supplies unless Executive Regulations allows it. This means that if a taxpayer purchased a debt for exempted operation and this debt is subject to RCM, the taxpayer shall self-assess VAT in RCM section of VAT return without crediting it in the recovery section.

Article 52(1) of the VAT Executive Regulation permits recovery for the ‘the supplies of financial Services, where the place of supply of these Services is treated as outside the State and the Recipient of Services is outside the State at the time when the Services are performed’.

The debt recovery services are taxable financial servicesSection 4.3.12 of the FTA’s Financial Services VAT Guide No. VATGFS1. Therefore, VAT related to them, including RCM, is recoverable.

In contrast, the Company’s operations with simple transfer debts do not lead to any taxable supply. Therefore, incurred VAT, including RCM (if applicable), is not recoverable. However, if the conditions specified above for disregarding Simple Transfer model are not met (e.g. debt purchased below its market value), the discount shall be treated as consideration for the financial services. This returns us to a scenario where VAT related to taxable supplies is recoverable.

20. Supplies which are subject to RCM count toward registration threshold. They prevent the taxpayer, whose operations include only zero-rating supplies from receiving exclusion from the registration.

21. Art. 48(1) of VAT Law the Taxable Person shall be treated as making a Taxable Supply to himself, and shall be responsible for all applicable Tax obligations and accounting for Due Tax in respect of ‘import of Concerned Goods or Concerned Services for the purposes of his Business’.

22. As per Section 7.4 of the VAT Taxable Person Guide, the reverse charge mechanism (RCM) ‘applies where:

- the place of supply is in the UAE;

- the supply would be subject to VAT in the UAE;

- the supplier’s place of residence is outside UAE;

- the recipient’s place of residence is in the UAE; and

- the recipient is VAT registered in the UAE’.

23. RCM is applicable only to Concerned Goods and Concerned Services. Article 1 of VAT Law defines “Concerned Services” as ‘Services that have been imported, where the place of supply is considered to be in the State, and would not be exempt if supplied in the State’.

24. As determined earlier, in debt recovery scenario (with fees involved) the service is supplied by the Company (assignee) rather when client (assignor). The latter assigns the right not as a service but to use this right in debt collection services. It may be obvious where power of attorney is issued. It also vests the attorney with certain rights but there’s no service provided with granting such right to an attorney.

Rather, attorney is the one who supplies services facilitate by the client’s assignment.

Therefore, we believe that assignment of debt in such scenario shall be disregarded for VAT. It means that VAT place of supply, zero-rating and threshold issues shouldn’t be affected by the transfer of debt to the service provider.

25. The Irish Revenue confirms it using:

- this wording: ‘where an assignment of the debt is made in return for a factoring service, Revenue will disregard the assignment or its reassignment for VAT purposes’, and

- this: ‘The equitable or legal assignment of title to debts in favour of a Factor pursuant to a Factoring Agreement is disregarded for VAT purposes’.

26. In simple transfer of debt scenario (with no fee and with no or eligible discount), transfer of the debt is not a constituent of a service provided by the collector. Therefore above logic is inapplicable.

This scenario is specifically addressed by the European VAT Commission in Working Paper No. 917:

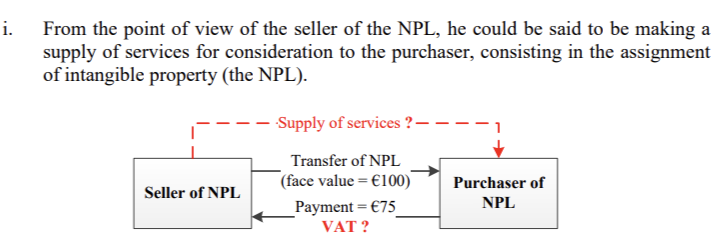

The Committee opined that ‘the transfer against payment of an NPLNon-performing loans.by the seller to the purchaser seems to constitute a taxable supply of services (from the seller to the purchaser), on the basis of Article 25(a) of the VAT Directive. This provision establishes that "a supply of services may consist, inter alia, in the assignment of intangible property, whether or not the subject of a document establishing title".’ The Art. 8(1) of the VAT Executive Regulation uses similar wording. Thus, the consideration of the Committee is relevant to interpret this UAE rule.

27. Being deemed as supply is not enough to in-scope transaction for VAT. In the UAE and EU only a supply of Services for Consideration is taxable.

Therefore at this point, the Committee examines ‘whether that supply of services has been effected for consideration’. The Committee clarifies that ‘the sale of the NPL takes place within the framework of a legal relationship between the parties of the transaction, which entails a reciprocal performance and mutual obligations between the parties (the supply of the loan is made in exchange for the payment and vice versa). This direct link between the supply of the NPL and the consideration paid means that the criteria laid down by the CJEU for a taxable supply to exist would be fulfilled.

Thus, the transfer of debt is a supply for consideration.

28. In the UK, the HMRC treats transfer of the debt as exempt supply for the originator. In Sec. 5.1 VAT Notice 701/49, the HMRC rules that ‘the unencumbered sale of debt for a consideration is exempt. The value of the supply is the gross amount that the purchaser pays for the debt’.

The exemption referred to by the authorities is envisaged in Articles 135(1)(b) and 135(1)(d) of the EU VAT Directive Council Directive 2006/112/EC of 28 November 2006 on the common system of VAT.. It exempts:

(b) ‘(the granting and the negotiation of credit and the management of credit by the person granting it; …

(d) transactions, including negotiation, concerning deposit and current accounts, payments, transfers, debts, cheques and other negotiable instruments, but excluding debt collection; (…)’.

EU VAT Committee stressed ‘the provision with the clearest link to the transaction at hand is the exemption for "transactions concerning debt" provided for under Article 135(1)(d) of the VAT Directive. Although not defined in the VAT Directive, this would cover cases consisting in the transfer of a right to a particular sum of money…’.

In Committee’s opinion, ‘the exemption for "the granting of credit" pursuant to Article 135(1)(b) of the VAT Directive, it does not seem possible that the transfer of an NPL could be covered by this provision as the case at hand would not fit into the scope of this exemption. The granting of credit refers to the provision of "new" money involving a change in the financial situation of the parties in a credit agreement. In contrast, the sale of an NPL does not entail the provision of money or any financial changes for the debtor, but just a switch concerning the creditor's identity of an already existing loan’.

However, the Committee opined that ‘the taxable supply of services consisting in the transfer of an NPL is nothing more than the mere transfer of debt, which gives to the purchaser of the NPL the right to a particular sum of money (the repayment of the debt); and this would therefore be covered by the exemption pursuant to Article 135(1)(d)’, i.e. exemption for “transactions concerning debt”.

29. The UAE is not a member of the EU. The interpretation given above for European VAT is relevant only if similar exemption is envisaged in the UAE legislation.

Clause 2 of Article 42 of the VAT Executive Regulation defines financial services as ‘services connected to dealings in money (or its equivalent) and the provision of credit’. This clause contains the list of examples of such services. It includes

(c) ‘The issue, allotment, drawing, acceptance, endorsement, or transfer of ownership of a debt security….

(e) The renewal or variation of a debt security, equity security, or credit contract.

(f) The provision, taking, variation, or release of a guarantee, indemnity, security, or bond in respect of the performance of obligations under a cheque, credit, equity security, debt security, or in respect of the activities specified in paragraphs (b) to (e) of this Article…

(i) The payment or collection of any amount of interest, principal, dividend, or other amount whatever in respect of any debt security, equity security, credit, and contract of life insurance.’

Clause 3(a) of this Article exempts these activities from VAT ‘where they are not conducted in return for an explicit fee, discount, commission, and rebate or similar’. Moreover, Cl. 3(b) exempts ‘the issue, allotment, or transfer of ownership of an equity security or a debt security’ without exeption from exemption given in Cl. 3(a), i.e. ‘the issue, allotment, or transfer of ownership of an equity security or a debt security’ stands for exemption even if this activity is ‘conducted in return for an explicit fee, discount, commission, and rebate or similar’.

Clause 4, however, stresses again that ‘activities under Clause 2 of this Article shall be subject to tax where the consideration payable in respect of a supply of Services is an explicit fee, commission, discount, and rebate or similar’. Nevertheless, we believe that this shall be interpreted in connection with Clause 3 where ‘the issue, allotment, or transfer of ownership of an equity security or a debt security’ are mentioned separately in para (b) from exemption in para (a) which covers whole set of services listed in the Clause 2.

Indeed, ‘the issue, allotment, or transfer of ownership of an equity security or a debt security’ (Article 42(3)(b)) are also mentioned in para (c) of Article 42(2) to which limitation from Clause 4 is applicable. We think this means that:

- a taxpayer which doesn’t pass explicit fee test under Clause 3 may not refer to para (c) of Art. 42(2) and para (a) of Art. 42(3),

- however, such taxpayer is still in position for the specific exemption for this operations under para (b) of Art. 42(3).

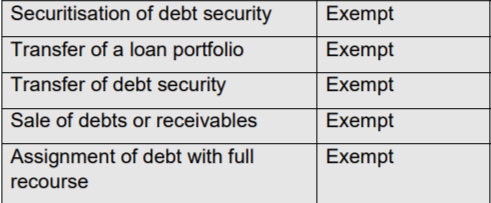

Section 4.1.15 of the FTA’s Financial Services VAT Guide No. VATGFS1 confirms this interpretation. It elucidates that:

- ‘financial services, insofar as they are remunerated by way of an implicit margin or spread (i.e. no explicit fee is charged in respect of them) will be exempt from VAT (i.e. they are not treated as taxable supplies)…

- In all cases, the following classes of financial services shall be exempt from VAT: … the issue, allotment, or transfer of ownership of an equity security or a debt security…’.

30. Above rules of Art. 42 of the VAT Executive Regulation operates the term “debt security” instead of “debt”. This could have hindered from applying these exemption to a debt without security, if there was no special definition to the term. Clause 1 of Art. 42 stipulates that ‘for the purposes of this Article … the phrase “debt security” means any interest in or right to be paid money that is, or is to be, owing by any Person, or any option to acquire any such interest or right’.

This definition doesn’t require any securitization of the debt to be treated as debt security for the purpose of Article. Therefore, we believe that operations with non-securitized debt also fall within the scope of exemptions reserved for “debt security”.

Table 5 in Appendix A of the FTA’s Financial Services VAT Guide No. VATGFS1 confirms this surmise. Among other exemption for deb securities the FTA instructs on exemption for a “securitization of the debt security”. This wording resolve doubts on whether debt before securitization is debt security:

31. The interpretation given in the EU to the wording akin to the wording used by the UAE in the similar provisions of Article 32 of the VAT Executive Regulation may not be treated too wide.

Giving this interpretation, VAT Committee proceeds from CJEU position which ‘has repeatedly stressed that the exemptions referred to in Article 135 of the VAT Directive are to be interpreted strictly’ Judgment of 19 July 2012, Deutsche Bank, C-44/11, EU:C:2012:484, paragraph 42. . Furthermore, the interpretation of the exemptions serves the purpose of the exemting rules which ‘is to avoid

divergences in the application of the VAT system as between one Member State and another…’. Working Paper No. 917, page 7.

The factor doesn’t include in his VAT return debt acquired by him (assigned to him). Therefore, the factor may not avail to Bed Debt Relief for the obtained debt.

34. The FTA doesn’t address issue on debt due to a factor. Therefore, we again seek verification of our conclusion in the jurisdictions where similar relief is granted.

In the UK the HMRC takes the same standing Section 5.7 of the HMRC’s VAT Notice 701/49: finance.

In the UK the HMRC takes the same standing Section 5.7 of the HMRC’s VAT Notice 701/49: finance.

clarifying that ‘a factor cannot claim bad debt relief for debts assigned to him by his client. The client cannot claim bad debt relief for a debt assigned to a factor but can do so if the factor re-assigns the debt to him’.

Disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law.

See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have status of the author’s opinion only. Like any human job, it may contain inaccuracy and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.