The UAE MoF in Article 2(1)(k) of the Decision No. 139 qualified for 0% Corporate Tax rate ‘Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale’.

Now, to interpret the part in bold we may use the FTA Public clarification VATP034 on Application of the Reverse Charge Mechanism on Electronic Devices among Registrants in the State for the purposes of VAT issued October 8, 2023.

The FTA clarified that “Resell” is ‘to be understood as being a part of the Business of the Recipient of the Electronic Devices to trade in such devices. The resale by the Recipient of the Electronic Devices can be at a wholesale or retail level. A Recipient who is acquiring the Electronic Devices for use in his business, other than for production or manufacturing, has no “intention to resell”. This is, for example, the case for the purchase of smartphones who then will be distributed, for employees are being charged for the receipt or use of the smartphones’.

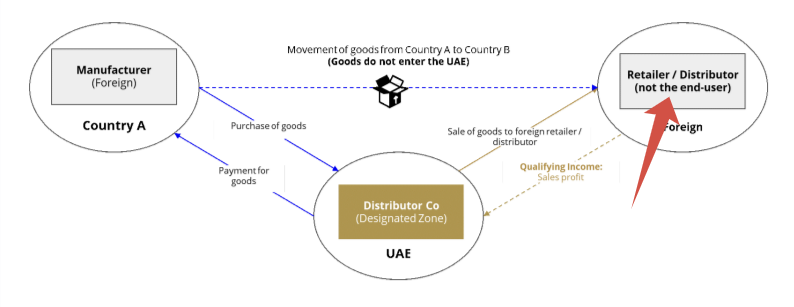

It is challenging example. The FTA’s interpretation is not in line with MoF Public Consultation Paper released this August. Check it out in the figure from the MoF:

Obviously, a company, which purchased devices to resell them to their employees, is not end-user of this devises.

Anyway, now we may add additional condition for a distribution to qualify for 0% CT rate. The FTA interpretation excludes from this benefit sales not only to end-users but also to other recipients who resold the goods but not as a part of their wholesale or retail business.