Here is another slide from the webinar we held last week. It demonstrates insights from one example in the Guide. There are 92 examples therein.

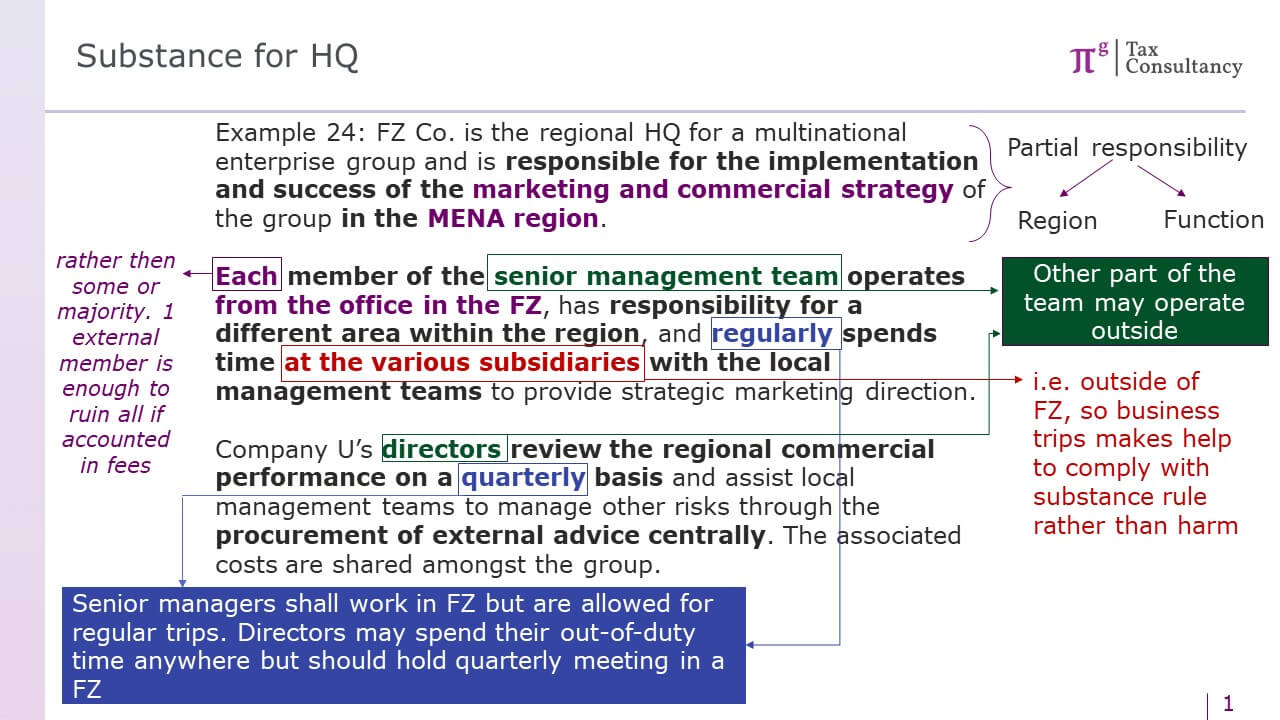

Example 24 deals with adequate substance requirements and demonstrates them in respect of Headquarter (HQ) Services. We elaborate on it in the slide. What are the major takeaways?

1. HQ services are Qualifying Activity and other intragroup services are not. How to distinguish between them? The responsibility is a tiebreaker. Each episode of support provided must be evaluated within a broader context:

a) Whether the FZ provider is responsible for the overall success of the group, or an important aspect of the group’s performance, and ensure corporate governance?

b) is this specific episode of support aimed at meeting specific needs of the company or it provided within a framework of the group performance?

In Example 24, the FTA illustrates how the responsibility for HQ activity could be segmented:

- it may geographical (MENA in this example), or (and)

- functional (responsible for the implementation and success of the marketing and commercial strategy of the group).

2. Localization of the Senior Management Team. This example shows that localization is required for the senior management team. The localization of other team members is apparently treated as support or routine functions, for which localization is not mandatory.

The same paragraph in the Example clarifies how localization should be arranged: ‘Each member of the senior management team operates from the office in the FZ’. Thus, ensure your employment contract specifies that the workplace of the relevant employees is defined as an FZ office.

3. Business Trips. If business trips are necessary for the group’s business, the manager will definitely leave the FZ area. The FTA shows in the Example that trips where a manager ‘regularly spends time at the various subsidiaries with the local management teams to provide strategic marketing direction’ do not hinder passing the substance test.

4. Threshold for the localization. The same paragraph states that ‘Each member of the senior management team operates from the office in the FZ’. This answers the question of why the FTA transferred almost everything from the Ministerial Guidance on Relevant Activities (ESR) to the Guide but omitted this rule: ‘For a decision to be seen as being made in the UAE, the majority of those making the decision should be physically present in the UAE’. In the Example, the FTA says “each member” rather than “majority”. Putting this all together leads to the conclusion that the majority rule works for ESR compliance but may raise issues for zero-rating HQ profit.

5. Directors’ Input. Finally, the FTA addresses directors’ input. Their place of operation also matters for CT substance compliance. While the senior managers must operate from a FZ office with business trips permitted, the directors are allowed to operate anywhere but must vis-it the FZ to ‘review the regional commercial performance on a quarterly basis’ and assist ‘local management teams’.

If you can gain that much from only one Example, imagine what a wealth of wisdom the entire Guide offers.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by pri-vate parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.

The Acknowledgment

This study has benefited from the contributions of the following people: Peter Brophy, Legal Editor and solicitor advising on English law, for his remarkable editing job; and Varvara Gunko for her assistance in the re-search.