On October 28, the Minister issued Decision No. 261, introducing pivotal updates under Article 5(2). This decision expands the scope of entities eligible for tax transparency, allowing 𝗮𝗻𝘆 𝗷𝘂𝗿𝗶𝗱𝗶𝗰𝗮𝗹 𝗽𝗲𝗿𝘀𝗼𝗻 𝘄𝗵𝗼𝗹𝗹𝘆 𝗼𝘄𝗻𝗲𝗱 𝗮𝗻𝗱 𝗰𝗼𝗻𝘁𝗿𝗼𝗹𝗹𝗲𝗱 𝗯𝘆 𝗮 𝗙𝗮𝗺𝗶𝗹𝘆 𝗙𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻 (whether directly or indirectly through an uninterrupted chain of Unincorporated Partnerships) to apply for transparent status.

What’s New?

Previously, entities established by Family Foundations to manage investments were ineligible for transparency. Being opaque, these entities faced the 9% Corporate Tax rate, even though certain income streams, like shares, could qualify for exemptions under the Participation Exemption.

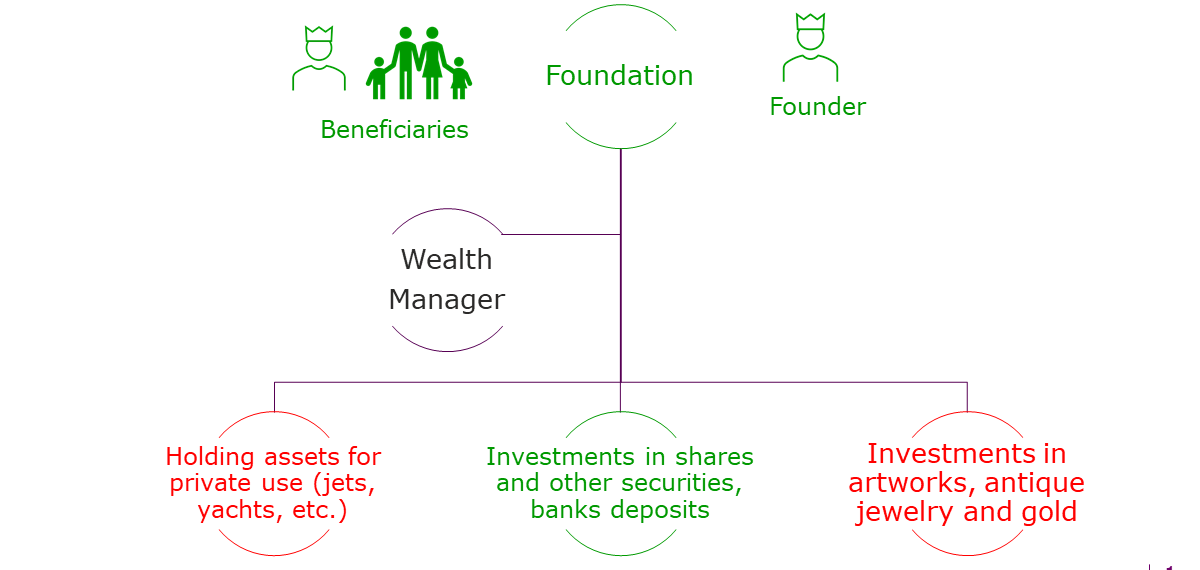

The slide illustrates these changes:

Green Entities сould technically benefit from a 0% rate but faced nearly impossible compliance burdens.

Red Entities remain outside the 0% rate scope. Real estate income often doesn’t qualify, and income from investments in artwork, jewelry, or antiques is excluded.

Under the earlier rules, foundations often had to hold assets by itself to avoid tax leakage. The new decision allows both eligible and ineligible entities to apply for tax transparency, offering relief from compliance challenges tied to zero-rating. Even entities eligible for the 0% rate can benefit from reduced compliance burdens with transparency status.

Wealth menagers play a critical role in this structure. Why? To qualify, an entity must not engage in activities that would constitute Business if performed directly by the founder, settlor, or beneficiaries. Our earlier research suggests that active investment management can be treated as a Business for listed individuals. Strategically outsourcing such functions helps mitigate risks.

Explore the opportunities these changes bring to optimize your family wealth structures.