Concept of POEM in the UAE Corporate Taxation

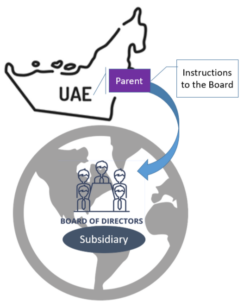

Article 11(3)(b) of the Corporate Tax Law deems as a tax resident ‘a juridical person that is incorporated or otherwise established or recognized under the applicable legislation of a foreign jurisdiction that is effectively managed and controlled in the State’.

Page 32 of the MoF’s Explanatory Guidance provides some clarification on this:

-

‘Whether a juridical person is effectively managed and controlled in the UAE needs to be determined with regard to the specific circumstances of the juridical entity and its activities’.

-

“A key factor” is ‘where key management and commercial decisions concerned with broader strategic and policy matters necessary for the conduct of the company’s business as a whole are regularly and predominantly made and given. This will ordinarily be where a company’s board of directors (or any equivalent body for other types of juridical persons) make these decisions’.

-

‘However, depending on the specific circumstances, other factors such as where the controlling shareholders make decisions, the location of another Person or body to which the board has delegated its decision-making functions, or the location where the directors or executive management of the juridical person reside may also need to be considered’.

-

‘For a juridical person to be considered effectively managed and controlled in the UAE, it is not necessary for its board members (or equivalent) to be domiciled or resident in the UAE’.

Example authorised by the FTA.Example 2 in para 1.3.2 of the General Corporate Tax Guide CTGGCT1.

C Ltd is a limited company registered in a foreign jurisdiction. C Ltd is mainly owned by an individual who resides in the UAE (Mr D). C Ltd’s annual board meetings are held outside of the UAE, in the country where the company is registered. These meetings are attended by local directors whose only involvement in the company is attending such meetings. The local directors do not receive information that would enable them to reasonably reach commercial decisions and they always follow the suggestions of Mr D. Mr D provides these suggestions remotely from his home in the UAE.

Based on these facts, it is likely that C Ltd is effectively managed and controlled from the UAE, as the local directors simply agree with all suggestions made by Mr D, and Mr D provides such suggestions from the UAE.

On page 39, the MoF emphasizes that ‘a foreign entity could have multiple places of management in different locations, but generally only one place of effective management and control for the purposes of Article 11(3)(b) at any one time, which is where the strategic decisions and powers regarding the management of the entity (as opposed to the day-to-day operations) are regularly and predominantly exercised’.

Advise 1: change substance rather than form.

A multinational group of companies is exposed to risk of POEM in the UAE if the actual key management decision-making and control functions are located in the UAE. Therefore, the group should identify the actual processes and responsibilities, and assess the ramifications for the true existing facts.

!

If such revision lays bare key management decision-making and control functions being performed in the UAE, the group may address this issue with actual changes in the decision-making and control processes.

The contract with directors, their role profiles and/or other documents should specify their functions and responsibilities as well as the location within which each particular director operates.

Advise 2: address other corporate body issues.

Check if a group company has (in addition to a Board of Directors) another corporate body with the authority to adopt key management decision-making or control functions (e.g. a control or supervisory Board). Effective control has to be located outside of the UAE, as well.

Statutory documents (the MoA, etc.) should be revised to make sure that the shareholder(s) has(have) no power to exercise key management or control (except as required by pertinent Commercial Company Laws and regulations).

For example, according to Article 277 of Bahrain’s Commercial Companies LawBahrain Decree-Law No. 21/2001 On the Issuance of the Commercial Companies Law

‘the company's Memorandum of Association may provide for the formation of a Board of Managers and specify the mode of operation of this board and the majority by which its decisions shall be passed’. Thus, it’s reasonable:

-

to check the MoA of Bahrain subsidiaries to make sure it doesn’t contain unfavorable wording;

-

to consider possibility of including in the MoA a favorable description for the “mode of operations” of the BoD.

It makes sense to conduct a similar check for other jurisdictions.

Advise 3: reckon with head-office and team factors.

On an international level, the freshest and most advanced clarifications for POEM were released on June 30, 2023 by the South African Revenue Service (SARS) in Issue 3 of Interpretation Note 6 (‘IN6’).

The Regulation on POEM in South Africa has similar features to the UAE tax regulation. Both jurisdictions operate to bind residency in with POEM without specifying this term.

As per IN6, POEM ‘must be ascribed its ordinary meaning, taking into account international precedent and interpretation’. SARS backs up its conclusion with the OECD’s guidance, national and international precedents, etc.

As per para 4.2.1 of IN6:

where the board meeting is held. Conversely, board meetings could be held more frequently but key management and commercial decisions may never-theless be made outside those board meetings’.

3) ‘Various members of senior management may operate, from time-to-time, at offices located in the various countries where the company operates. In these situations, the company’s head office would be the location where those senior managers are primarily or predominantly based or to where they normally return following travel to other locations or where they meet when formulating or deciding key strategies and policies for the company as a whole’.

Therefore, ‘past practice and general conduct’ shall be examined to identify the parties involved in the decision-making, weighing the importance of each party’s input, and thereby to establish a place where particular decision is taken.

The head-office factor is often underestimated in the taxpayers plans. Based on the above, we recommend:

-

to factor in the prime or predominant location of the directors rather than their residence,

-

to reckon with the prime or predominant location of the directors’ support staff.

We advise to examine the process of real decision-making based on past examples of key decisions already taken in the group. Inquire as to the process as a whole, from the moment where an issue originates to the moment and place where it has been resolved. Identify:

-

all persons and departments involved,

-

approvals required and collected,

-

presentations and meetings held,

-

actual stakeholders in the process of the decision-making process, i.e. people which approvals were required for a director to vote;

-

when and where the consideration of the potential discussion was held and who was involved;

-

at which moment the decision included in the minutes of the BoD’s meeting was actually predetermined.

Such investigation is a route for a “smart” tax audit. If it isn’t, it is a route for a taxpayer to refute a POEM claim. Therefore, such or a similar examination should precede the elaboration of an Action Plan. Otherwise, risks inherent to actual decision making will not be identified and properly addressed.

Advise 4: senior management.

As already mentioned, the taxpayers often focus on the meetings of the BoD only. However, senior management may also make or at least be involved in making key senior management decisions.

The FTA stipulates that POEM ‘could be the place where the highest level of decisions that are essential for the management of the juridical person are made, or where decisions that play a leading part in the management of a company from an economic and functional perspective are made’.General Corporate Tax Guide CTGGCT1, Section 5.3.2.

Therefore, not only the ‘highest level of the decisions’ matters.

The MoF CT Explanatory Guidance stresses that for the purpose of POEM ‘a distinction should be made between the board or equivalent senior management of an entity, which takes the strategic decisions, and the day-to-day management, which takes the implementing decisions’. Hence, senior management’s strategic decision is a factor to reckon with.

The FTA also offers a guide that ‘typically, this will be where a company’s board of directors (or any equivalent body for other types of juridical persons) makes these decisions’. However, “typically” may not exclude cases mentioned by the FTA earlier ‘where decisions that play a leading part in the management of a company … are made’ not at ‘the highest level’.

Moreover, the FTA proceeds with a reservation: ‘However, depending on the specific facts and circumstances, other factors such as where the controlling shareholders make decisions, the location of another Person or body to which the board has delegated its decision-making powers, or the location where the board members or executive management of the juridical person reside may also need to be considered…’.

Thus having senior managers authorized to take strategic decisions in the state where the subsidiary is incorporated may further mitigate exposure to POEM risks.

International practice also factor senior management decisions in the scope of POEM test.

The KSA Minister of Finance in the Resolution No. (2194) on 14 June 2011 the Minister of Finance, addressed ‘the importance of defining the meaning of the term of the “headquarters” stipulated in Paragraph (B/2) of Article (3) of Income Tax Law, stated that a company shall be considered a resident in Kingdom of Saudi Arabia … if … its central management is located in the Kingdom’.

The Minister determined “central management” as a ‘location where the high policies and the main and necessary administrative and commercial resolutions are mainly developed and taken to carry out the company’s businesses in general’. Thus, this term is alike in purposes to the term of POEM in the UAE.

As per this Decision, ‘the central management is considered a resident in KSA if meets two at least of the following conditions:

-

Holding the ordinary meetings of the board of directors, that are carried out in a regular basis on which the main policies and resolutions are taken that are related to managing the company and performing business thereof in KSA.

-

Taking the high executive decisions related to managing jobs of the company, such as the decisions taken by the executive manager and deputies thereof in KSA.

-

Most business of the company, from which the most revenues thereof are achieved, are carried out in KSA’.

In the absence of a special (for POEM) definition of the senior management for POEM purposes, it’s worth referring to the international level.

In 2023 SARS determines the senior management as ‘the level of employees of a company who are generally responsible for developing and formulating key strategies and policies for the company and for ensuring or overseeing the execution and implementation of those strategies on a regular and on-going basis. While terminology may vary, these employees may include –

-

Managing Director or Chief Executive Officer;

-

Financial Director or Chief Financial Officer;

-

Chief Operating Officer; and

-

the heads of various divisions or departments (for example, Chief Information or Technology Officer, Director for Sales or Marketing)’.

India’s CBDT in Circular no.6 of 24 January 2017, placing a focus on POEM, gave an identical definition of the POEM. The CBDT also clarifies that ‘in certain situations it may happen that person responsible for operational decision is the same person who is responsible for the key management and commercial decision. In such cases it will be necessary to distinguish the two type of decisions and thereafter assess the location where the key management and commercial decisions are taken’Para 8.2(g).

Therefore, it is reasonable on regular basis to:

-

identify the senior management which is allowed to make decisions relevant for POEM;

-

monitor decisions of the senior management,

-

assess their significance for the subsidiary,

-

keep evidence to demonstrate that local senior management and their teams, located abroad, have been involved in making management and commercial decisions related to a functioning of the entity as a whole.

Advise 5: extra-caution required with HQ services

Intragroup headquarter services (HQ) may aggregate POEM related risks.

The UAE ESR is applicable to the billing of HQ services from the. This activity requires ‘taking relevant management decisions’ in the UAE. i.e. ‘making decisions on the substantive functions and significant risks for group companies, such as decisions on material acquisitions and purchases, the group companies’ sales and marketing strategy, product development, business process standardization, etc.’Article 2.5 of the Relevant Activities Guidance, attached as a schedule to the UAE Minister of Finance’s Decision No. 100 for 2020.

It is very close to the ‘key factor’ mentioned in bold above in the CT Explanatory Guidance.Therefore, this type of decision-making in the UAE could entail a tax dispute between a foreign subsidiary and the FTA on tax residency.

As you may see, taxpayers engaged in the HQ business are in a sort of a vicious circle:

-

to pass the ESR test they need to prove that decision making is performed in the UAE,

-

if they succeed proving this, they are exposed to a tax dispute on POEM tax residency.

To break this vicious circle, companies should consider excluding both:

-

strategic decision-making from CIGA conducted in the UAE (this should mitigate the risk of a tax dispute on the residency of the subsidiary),

-

charges for this activity (this should eliminate the obligation to comply with ESR for decision-making activity).

Disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law.

See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have status of the author’s opinion only. Like any human job, it may contain inaccuracy and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.