The UAE’s FTA issued Transfer Pricing Guide No. CTGTP1 this week. For the most part, people are impressed with its length. Don’t be scared. A hefty part of it is a repetition of the OECD TP Guidelines for Multinational Enterprises and Tax Administrations (OECD TP Guidelines) issued on January 20, 2022.

The OECD Guidelines are much thicker, with plenty of examples skipped in the FTA’s version. So, the OECD’s Guidelines may help to pick up the slack where the FTA’s Guide is silent. However, local TP shall prevail. On balance, the FTA sets forth the following hierarchical algorithm:

- Taxable Persons should rely primarily on the Corporate Tax Law, Ministerial Decision No. 97 of 2023, and this Guide for Transfer Pricing matters involving the UAE.

- This Guide should be the primary source of guidance for Transfer Pricing related matters prevailing over international standards,

- If a certain aspect is not covered, taxpayers are encouraged to refer to the OECD TP Guidelines if an issue is not addressed herein.

The facts

We consider the facts addressed in the Example 22 of the FTA’s TP Guide to determine where this scenario is legal from the ESR standpoint.

The question

Is this structure of IP licensing legal from the economic substance regulation (ESR) standpoint?

The analysis

A High Risk IP Licensee is defined under Article 1 of Resolution No. 57 as a case where all of the following three requirements are met:

- The Licensee did not create the IP Asset which it holds for the purpose of its business, and

- The Licensee acquired the IP Asset from either;

- A Connected Person; or

- In consideration for funding research and development by another person situated in a foreign jurisdiction; and

- The Licensee licenses or has sold the IP Asset to one or more group companies, or otherwise earns separately identifiable gross income (e.g. royalties, licence fees) from a foreign group company in respect of the use or exploitation of the IP asset.

Where these 3 conditions are met, a Licensee must rebut the presumption of non-compliance with ESR. To do this, ‘the Licensee must provide sufficient evidence supporting that it has, and has historically had, a high degree of control over the development, enhancement, maintenance, protection and exploitation (the so-called “DEMPE functions”) of the IP Asset’.

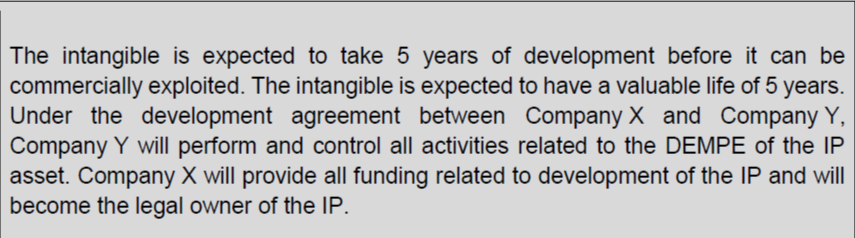

In the Example cited above:

- An MNE Group comprises of Company X and Company Y;

- Company Y will perform and control all activities related to the DEMPE of the IP asset;

- Company X will provide all funding related to development of the IP and will become the legal owner of the IP;

- Once developed, Company Y will license the asset from Company X and pay a license fee based on comparable market data.

So, in this case:

- all 3 conditions are met to qualify for High Risk IP Business, on the one hand, and

- Company X may not rebut the presumption with evidence of control over DEMPE.

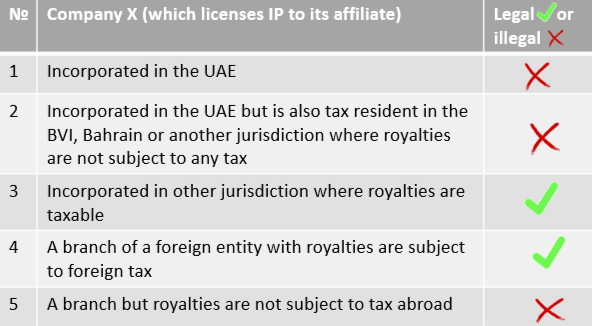

Thus, this business is illegal if Company Y is a tax resident of the UAE unless an exemption from the ESR is applicable. You will find some examples of the ESR treatment in the table:

The conclusion

In a case where the owner of the IP assets is under the UAE’s economic substance regulations:

- The FTA may add an ESR penalty to Company X’s tax bill.

- Company X is subject to an ESR penalty even if Arm’s Length is met.

Please note that a violation of the ESR twice in a row may trigger the license being suspended, not renewed or revoked.

The disclaimer

Pursuant to the MoF’s press-release issued on 19tb May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.