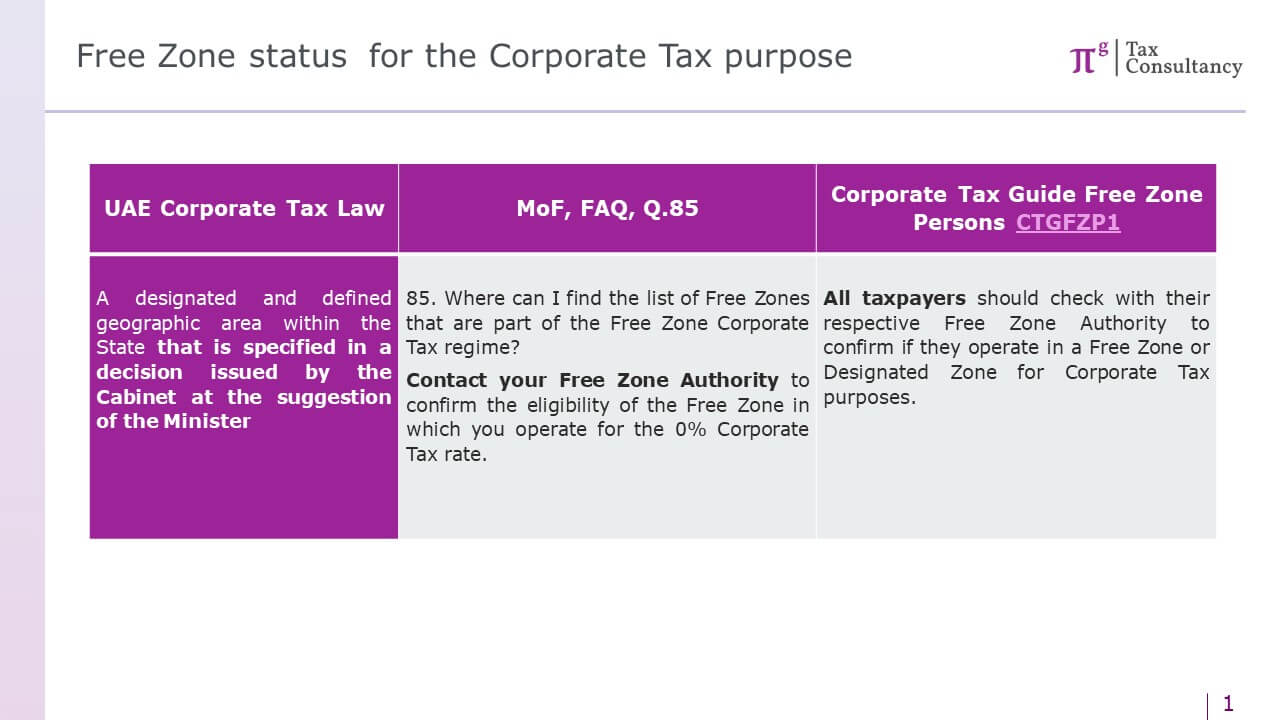

In the Free Zone Persons Guide, The FTA instructs ‘all taxpayers’ to ‘check with their respective Free Zone Authority to confirm if they operate in a Free Zone or Designated Zone for Corporate Tax purposes’. The first slide shows how this responsibility transitioned from the Cabinet to the Free Zone authorities.

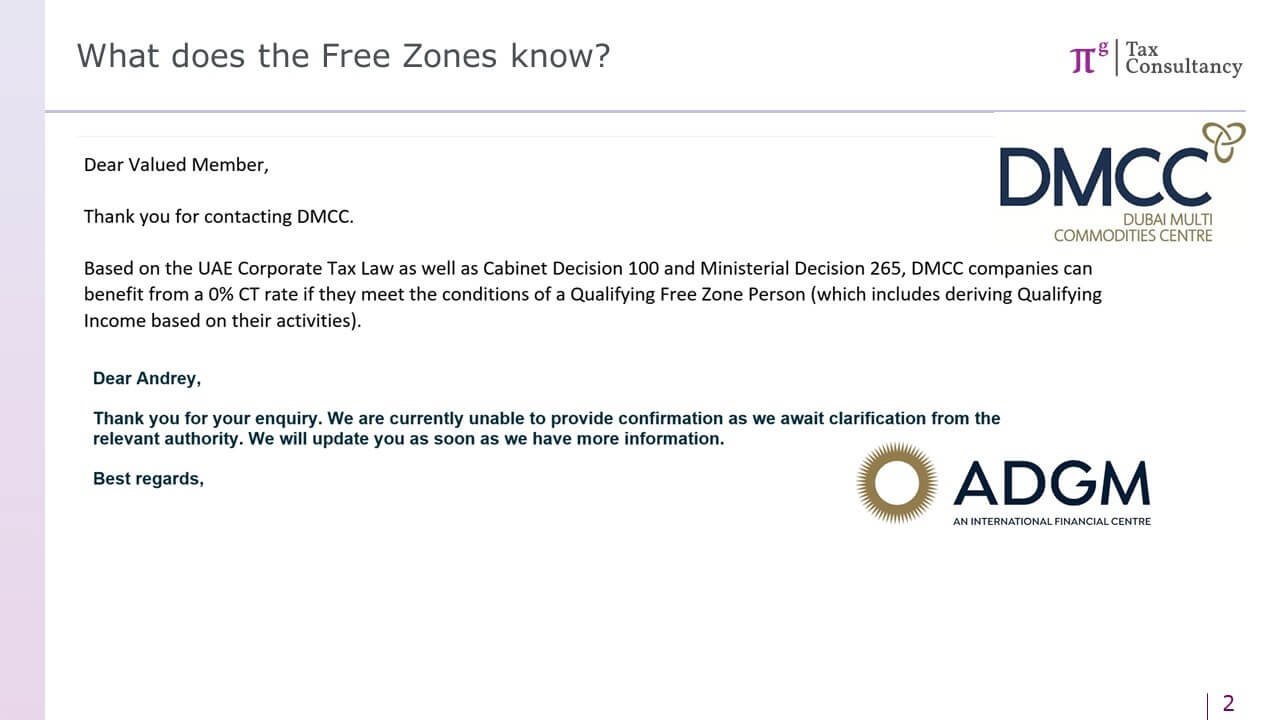

In the 2nd slide, you may find emails received from various Free Zone authorities regarding their status. The most common responses from these authorities include:

- no feedback at all (1st place in the rating of popularity),

- redirecting inquiries to others (such as the FTA, MoF, tax lawyers, and consultants),

- assurances that they are working on it, and

- confirmations of their Free Zone status for CT purposes.

Notably, no zone has denied having Free Zone status for CT purposes.

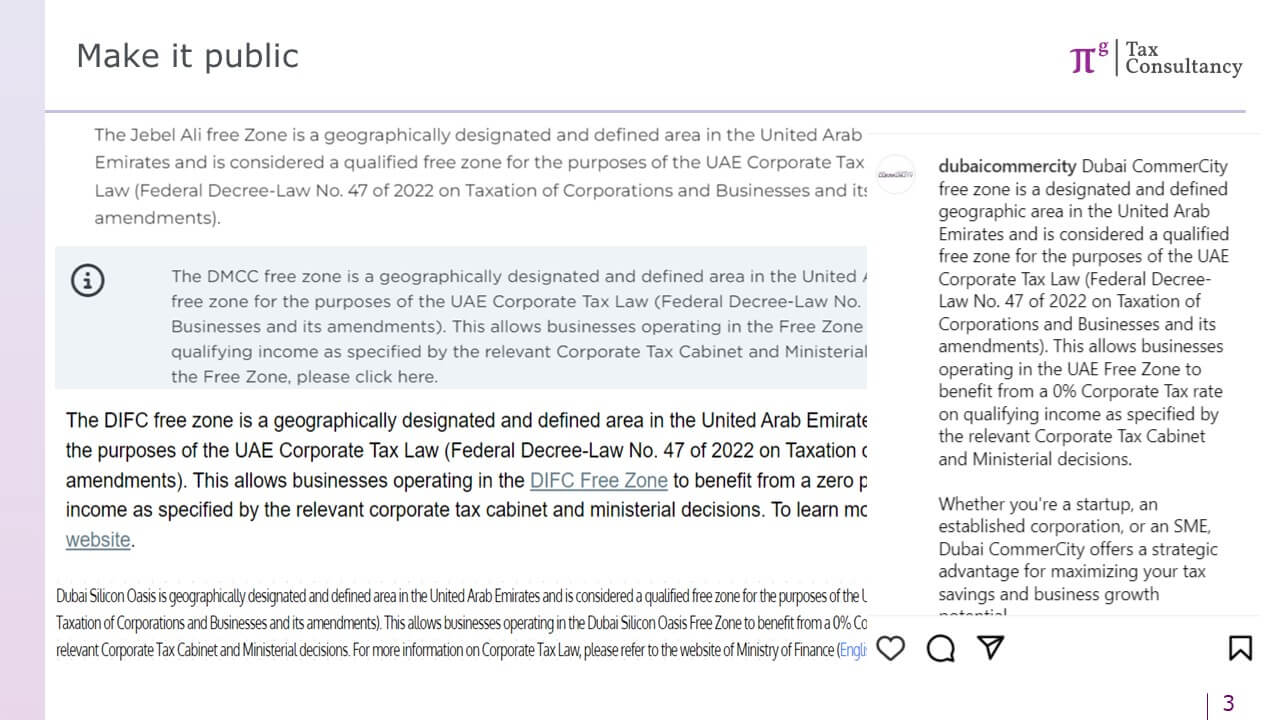

Five zones have made their status public (DIFC, DMCC, JAFZA, DSO, and DCC), as highlighted in the 3rd slide.

It’s intriguing why the remaining zones are keeping a low profile. Those that have confirmed their status in private emails should consider announcing it publicly on their web platforms. Given the high demand for qualifying free zones, having an approved status for CT purposes is a significant promotional advantage. Why hide such a valuable asset?