The facts

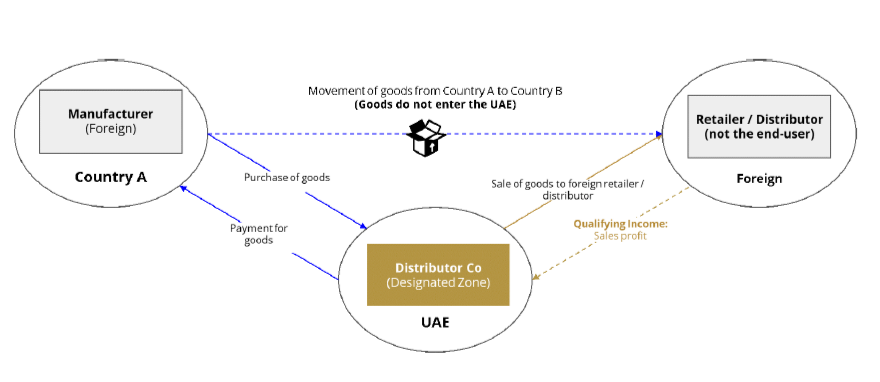

A distribution company is incorporated in a designated zone in the UAE. Its facilities are located in the designated zone from where its employees buy the goods in China, resell them to Indian customers, and arrange shipment of the bought goods to an Indian customer for subsequent resale. The goods do not enter the UAE and its free zone (designated zones).

On 27 October 2023, the MoF issued Decision No. 265, replacing Decision No. 139 with a list of Qualifying and Excluded Activities.

The rules concerning distribution from or in a designated zone haven’t been substantially changed.

The question

Does such distribution of goods outside of the UAE qualify for 0% Corporate Income Tax (CIT)?

The analysis

On 1 June 2023, the MoF released the list of qualifying activities in its Decision No. 139/2023. Art. (2)(1)(k) of this Decision includes the ‘distribution of goods or materials in or from a Designated Zone to a customer that resells such goods … or alters such goods … for the purposes of sale or resale’. Clause 3 of the same Article sets out that ‘the activity of distributing goods or materials must be undertaken in or from a Designated Zone and the goods or materials entering the State must be imported through the Designated Zone’.

In June Public awareness sessions, the MoF clarified that in this scenario income of the Free Zone person is qualified regardless of the fact that the goods do not enter the UAE and are not ‘imported through the Designated Zone’.

In August, the MoF launched a digital public consultation on its website as part of the UAE Corporate Tax’s Free Zone regulations. Para 3.11 of the Public Consultation Document (PCD) gives examples of what shall be interpreted as “distribution in or from designated zone”.

Scope

The distribution of goods or materials includes the buying and selling of products, materials, component parts or any other items that are tangible or movable, but not including financial assets and instruments, in or from a Designated Zone*.

…

Illustrations

(1)Distribution of goods or materials outside of the UAE – A Designated Free Zone Person (Distributor Co) buys goods from a manufacturer in Country A, and sells these goods to a retailer in Country B. Distributor Co earns a profit / margin on the goods sold to the retailer in Country B. The goods are shipped directly from the Manufacturer in Country A to the Retailer in Country B.

The question to be answered is why the MoF hasn’t included in its new Decision No. 265 this illustration of its earlier opinion?

Answering this question, tax experts do not come to a common conclusion:

- Some believe that distribution from a Designated Zone but outside of the UAE doesn’t comply with the wording of Art. (2)(2) of the earlier Ministerial Decision. Therefore, the MoF proposed to change this wording to cover the example given by the MoF in course of the digital consultation. As the relevant part has not changed, the proposal of the MoF hasn’t been eventually accepted;

- Others believe that changes have been introduced only for those positions that require changes. With regard to distribution, the Ministry of Finance, in the public awareness sessions in June 2023 and in a public consultation document, only gave its interpretation of the wording of the existing rules. Thus, an amendment would be required only if the Ministry planned to change the current regulation and disqualify outside distribution. Therefore, the absence of changes in relation to distribution evidences that this order remains unchanged. So does the position of the Ministry.

We lean in favor of the latter approach.

In our opinion, the current wording of the Articles (2)(1)(l) and (2)(3)(l) keeps the opportunity to qualify distribution outside of the UAE.

The new Ministerial Decision sets forth that the ‘distribution of goods or materials in or from a Designated Zone, includes the buying and selling of goods, materials, component parts or any other items that are tangible or movable and may include the importation, storage, inventory management, handling, transportation and exportation of those goods or materials to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale, provided such activities are conducted in or from a Designated Zone and the goods or materials entering the State are imported through the Designated Zone’.

Literally, these rules can be interpreted in two different ways:

- the activity of distributing goods or materials falls under the scope of Qualifying Activity scope only if the goods or materials are imported through the Designated Zone;

- to be Qualifying, the activity of distributing goods or materials must be: 1) undertaken in or from a Designated Zone and 2) if the goods or materials enter the State, they must be imported through the Designated Zone.

The 1st way of the interpretation is not compatible with the inclusion of “exporting” in the description of the qualifying distribution. Let’s omit the part that is irrelevant for exportation from Art. 2(3)(1) cited in full above. This is what we have: ‘‘distribution of goods … may include … exportation of those goods …, provided such activities are conducted in or from a Designated Zone and the goods … entering the State are imported through the Designated Zone’. You may not perform exportation when importing goods into the State. In doing so, you conduct importation, which is also in the list.

If goods need to be imported to qualify, exporting shall not be included in the list. But it is. Therefore:

- import through a designated zone is rather an additional condition to be met in a case where goods are imported into the mainland;

- where this is not the case, this part of the rule ‘and the goods or materials entering the State are imported through the Designated Zone’ is irrelevant;

- its irrelevancy doesn’t hinder the application of the relevant part, which is ‘provided such activities are conducted in or from a Designated Zone’.

The conclusion

It is still not clear whether the distribution where the goods do not enter the State qualifies for the 0% Corporate Tax Rate. However, there are a number of compelling arguments to sustain the Ministerial positive answer given before. The list of operations included in the qualifying distribution increases this number.

Certainty may be obtained from public guidance from the Ministry of FTA. It may also be obtained via a private clarification from the FTA.

As per para 8 of the FTA’s Private Clarifications Guide TPGPC1, ‘the FTA considers itself administratively bound to follow the position set out in the Clarification where the factual circumstances are materially the same as set out in the clarification form’.

Currently, such clarifications are only available for VAT and Excise Tax. As far as Corporate Tax is concerned, only registration issues may be clarified at present. The FTA will announce the date from which a wider scope will be accepted for clarification requests.

The disclaimer

Pursuant to the MoF’s press-release issued on 19tb May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.