The facts

An individual has been serving as a sole director in three companies simultaneously. All companies are registered in ADGM.

The question

Is his remuneration subject to UAE Corporate Tax?

The summary

After considering the facts and the analysis below, we opine as follows:

- Individuals pay corporate tax if their activity is recognized as a business in the UAE. The definition of a business consists of evaluative concepts. The FTA lays down that a director's services do not meet this definition. Nonetheless, the FTA:

- uses a reservation such “as a general rule”. This indicates that there may be exceptions. However, the FTA does not provide any guidance for them;

- indicates that the business’s attributes shall be assessed on a case-by-case basis;

- accompanies favorable conclusions with formulas such as “in the circumstances set out above” or “would typically be considered" in the examples.

All this shows that the FTA is reserving its position for potential disputes with an unfavorable construction.

- In such a situation, it makes sense:

- to ensure the closest conformity to the examples given by the FTA;

- to provide a backup option, in which even with the qualification of the activity as a business, the obligation to pay corporate tax does not arise.

- If the director's remuneration from all companies combined with business income (if any) does not exceed AED 1 million, then there are no Corporate Tax risks. If this is the case, even the recognition of the director's remuneration as derived from a business does not lead to Corporate Tax obligations. Therefore, further conclusions are relevant only if these revenues exceed AED 1 million.

- If the director has an employment contract (for example, for the function of a manager) in addition to the director's service contract, this will reduce the risk of the director's activities being recognized as independent. Independence is one of the principal criteria by which a director's activities are distinguished from business.

- Moreover, wages for such an employment contract don’t count towards the AED 1 million threshold. Therefore, it makes sense to divide the functions between service and employment contracts, distributing functions and remuneration as much as possible in favor of the latter. The arm’s length rules, substance and truth should be honored in such distribution.

- It also makes sense to arrange the service contract itself so that it contains as many elements of the employment contract as possible. Again, such an arrangement must be in concert with the true facts.

- The Standard Articles of Association of the Company in ADGM include provisions that can characterize the director's activities as independent and lead to them being qualified as a business. However, most of these provisions are optional and can be replaced with terms circumscribing the independence of the director from the Company.

The analysis

1. Article 11(3)(c) of the Corporate tax Law states that an individual who is a tax resident of the UAE is obliged to pay corporate tax if he carries out Business or Business Activity in the UAE.

Article 1 of the Law defines Business as: ‘Any activity conducted regularly, on an ongoing and independent basis by any Person and in any location, such as industrial, commercial, agricultural, vocational, professional, service or excavation activities or any other activity related to the use of tangible or intangible properties’.

Thus, the mandatory signs of a Business are:

- the presence of activity in one of the specified forms;

- its implementation:

- regularly;

- on an ongoing basis;

- on an independent basis.

2. Para.1 Art.2 of Cabinet Decision No. 49 dated 05/08/2023 sets forth that ‘for the purposes of … the Corporate Tax Law, Businesses or Business Activities, conducted by a resident or non-resident natural person, shall be subject to Corporate Tax only where the total Turnover derived from such Businesses or Business Activities exceeds AED 1,000,000 … within a Gregorian calendar year’. Thus, if the remuneration of the director from several companies in combination with income from business activities does not exceed AED 1 million, then there are no corporate tax obligations anyway.

3. At the same time, wages are not recognized as income from business activity by virtue of Art. 2(2)(a) of the Cabinet Decision No. 49 dated 05/08/2023: ‘… activities that give rise to Turnover from the following sources shall not be considered as Businesses or Business Activities …, regardless of the amount of Turnover derived from such activities: … Wage’.

4. The MoF has posted answers to FAQ on its website.

Question 30 is ‘What is considered as a ‘Business or Business Activity’ conducted by a natural person that is subject to tax?. The answer is: ‘A natural person will be subject to UAE Corporate Tax when performing any Business or Business Activity generating an annual Turnover in excess of AED 1 million. This excludes income generated by a natural person from the following sources, that are not considered as Businesses or Business Activities:

- Employment income;

- Personal Investment income;

- Real Estate Investment income”.

To Question 34 (‘Will a natural person’s employment income be subject to UAE Corporate Tax?’), the MoF replies: ‘UAE Corporate Tax does not apply on the salary and wages derived by employees in consideration for their services under an employment contract, including all allowances and bonuses’.

Therefore, a director who receives remuneration under an employment contract is unlikely to be qualified as an operating Business.

5. Activities in the form of services may be the most relevant of all the forms listed in Art. 1 of the Corporate Tax Law to the situation at hand.

Article 214 of the ADGM Company Regulation 2020 stipulates that ‘for the purposes of this Part a director’s “service contract”, in relation to a company, means a contract under which

- a director of the company undertakes personally to perform services (as director or otherwise) for the company, or for a subsidiary of the company, or

- services (as director or otherwise) that a director of the company undertakes personally to perform are made available by a third party to the company, or to a subsidiary of the company’.

The UAE’s Labor Law No. 33/2021 does not distinguish between the definitions of service and of work, using them interchangeably, and does not contrast them. Thus, a director's activities under contracts whose subject matter is the provision of services but not work do not generate significant risks.

6. In the Corporate Tax Guide “Taxation of natural persons...” No. CTGTNP1, the remuneration of a director is considered in Sec. 3.8.1 “Wage". It provides for the following:

- ‘Wage, including any compensation or benefit received, whether in cash or in-kind, by any employee from their employer is not subject to Corporate Tax. Thus, a salary or other form of remuneration received by a natural person as an employee from their employer would not fall within the scope of Corporate Tax. The question of whether a natural person is an employee and earns a salary or other form of remuneration as such, is a question of fact to be determined on a case-by-case basis’.

- ‘A natural person appointed as a director, for example as a member of the board of directors of a Public Joint Stock Company, may receive fees and other similar payments for carrying out this role, either in the course of their employment or as independent party appointed to a board of directors. Generally, director fees will not be considered as a Business or Business Activity, and therefore would not be subject to Corporate Tax’.

The FTA illustrates this with an example in which an individual works for a company under an employment contract and in addition serves as a member of the board of directors in the same company:

‘Mr. H holds a senior management position in the company and plays a crucial role in its day-to-day operations.

In addition to his employment responsibilities, he is a member of the board of directors. As an employee, Mr. H receives a market rate salary for his executive role, which is determined by his employment contract and is subject to applicable employment laws.

As a board member of the company, Mr. H also receives fees from the company for attending board meetings.

The salary received by Mr. H is in the nature of a Wage and accordingly is not subject to Corporate Tax.

In addition, the remuneration received by Mr. H in their capacity as a member of the board of directors in the circumstances as set out above, would typically be considered a Wage in the same way as an employee's salary and accordingly is not subject to Corporate Tax’.

It is noteworthy that the FTA illustrates its position with an example where the director is already an employee of the company’s management structure. This matters because, in such a situation, the service contract with the director is only an extension of the employment relationship.

7. It seems that, in the case of ADGM, the presence of a director with a service contract does not prevent him from being a member of the Board of Directors under the same contract. This complicates considerably the different qualification of payments under such a contract.

This can both help and harm the director in the following ways:

- the FTA may conclude that the director does not receive a ‘wage or other compensation as such’ at all, namely, all his remuneration is business income,

- or it may come to the opposite conclusion, qualifying all the income as a wage.

8. Pursuant to the ADGM Model Articles of Association of an ADGM private company limited by shares:

- ‘Directors may undertake any services for the company that the directors decide.[1] Unless the directors decide otherwise, directors are not accountable to the company for any remuneration which they receive as directors or other officers or employees of the company’s subsidiaries or of any other body corporate in which the company is interested’.[2]

- ‘Subject to the articles, the directors may make any rule which they think fit about how they take decisions, and about how such rules are to be recorded or communicated to directors’.[3]

- ‘If— (a) the company only has one director, and (b) no provision of the articles requires it to have more than one director, the general rule does not apply, and the director may take decisions without regard to any of the provisions of the articles relating to directors’ decision-making’.[4]

These rules substantially distinguish the position of a director from that of an employee. In a standard contract with an employee[5], the latter is obliged to:

- ‘… to comply with the employment policies, practices, rules and instructions of the Company currently in force or which hereafter may be amended, revised or adopted in the sole discretion of the Company from time to time’.

- ‘[to] comply at all times with such additional duties and obligations as are set out in the Employee handbook [annexed as Schedule 1 to this Contract] which may be altered by the Company from time to time in its sole discretion by way of a written notice to the Employee. In the event of a conflict between this Contract and the said Employee handbook, the provisions of this Contract shall prevail’.

This difference matters because the Business includes such an attribute of a person's activity as being independent. The above wording of the contract with the director corresponds to this characteristic to a much greater extent than the wording in the employment contract.

9. On the other hand, the Model Articles of Association stipulate that ‘subject to the articles, the directors are responsible for the management of the company’s business, for which purpose they may exercise all the powers of the company’. Thus, the activity of the directors is limited to the exercise of the rights belonging to the company, and cannot go beyond these limits. This focuses on the fact that the activities of the director should not be considered independent in relation to the activities of the company itself.

10. The concept of “regularly” is not disclosed in Corporate Tax legislation. The content of this term can be deduced from paragraph (3) of Schedule 1 to ADGM Financial Services And Markets Regulations of 2015. It determines that ‘a person carries on an activity by way of business if the person—

- engages in the activity in a manner which in itself constitutes the carrying on of a business;

- holds himself out as willing and able to engage in that activity; or

- regularly solicits other persons to engage with him in transactions constituting that activity”.

Thus, regularity implies an activity aimed at repeatedly selling a service or work. The presence of the three simultaneous service contracts can be interpreted as a sign of efforts being regularly made to sell the director's services.

11. Meanwhile subparagraph (a) of the above definition of business in ADGM can be used as confirmation that the director's activity is not independent, since he is only a proxy for the company's business, i.e. he does not ‘participate in activities in a way that in itself represents conducting business’.

12. The "ongoing" feature may hardly be used to distinguish the Business Activity from employment. The employee also carries out his activities constantly. Rather, this feature makes an “excuse” for other features of Business Activity being present. In other words, if all other features of Business are present episodically rather than constantly, then business activity is not recognized.

Nevertheless, the FTA provides the following explanations on this basis[6]: “Nevertheless, “ongoing” should not be interpreted in such a way so as to exclude short-term activities. As such, short-term activities can be within the scope of Corporate Tax on the basis that they constitute a “transaction or activity, or series of transactions or series of activities” as prescribed in the definition. The definition allows for a short-term commercial activity to be considered a Business for Corporate Tax purposes.

This is why the Corporate Tax Law refers to the “conduct” of a Business rather than the “carrying on” of a Business. Examples of activities conducted by a natural person that are not typically considered a Business or a Business Activity would include lottery winnings or game show prizes.

However, whether or not a Business is conducted on an ongoing basis will be evaluated on a case-by-case basis”.

13. The Law on Commercial Transactions contains rules defining commercial business. Some rules can help the director, whereas others may be harmful.

Article 5(7) of Federal Commercial Transactions Law No. 50 of 03/10/2022 provides that “Works of incorporation of commercial companies” are categorized as “commercial business” by virtue of their nature.

This does not literally apply to a director's activities. However, Art. 7 provides that ‘the works that can be considered equivalent to the works described in the two previous Articles for the similarity of their characters and purposes shall be considered commercial business’.

It is possible that the FTA will find common features between services for the establishment of commercial companies and services aimed at ensuring their functioning.

On the other hand, Art. 8(3) of the Law doesn’t deem as a commercial business ‘the work in which the individuals rely on their physical or mental effort to realize profit or a sum of money rather than relying on monetary capital’.

This is a perfect match for both a director's services and a vast number of services hinging on the use of intellectual efforts. However, the Corporate Tax Law provides its own definition of Business, which is clearly different from that given in the Law on Commercial Transactions. The above-mentioned Cabinet Decision No. 49 refers to this Law only for the definition of Personal Investment. Therefore, the FTA applies this law to define a Business only in this case. Furthermore, when applying it, the FTA emphasizes that: “… where an activity is not considered a commercial business as per the Commercial Transactions Law, it will not automatically be considered a Personal Investment activity, unless it is conducted on the person's personal account and is neither conducted through a Licence or required to be conducted through a Licence”.

Thus, the provisions of this Law should neither help nor harm a director.

14. 8(1) of the Executive Regulation to the UAE Employment Law juxtaposes Freelance arrangements and Employment: ‘Free Lance is an independent and flexible work arrangement, whereby the natural person generates income by providing his services for a specified period of time or performing a task or providing a specific service, whether for individuals or establishments, whereas this natural person is in no way a worker for those individuals or establishments’.

Federal employment laws and regulations are not applicable in ADGM[7]. However, the ADGM rules contain a similar contrast. The ADGM Work Permit Guide (April 2023) defines Temporary Freelancers as ‘individuals, not being employees, who provide services in or from ADGM on a temporary basis, who are not under the exclusive direction and control of an ADGM Licensed Person, and who hold a freelancer license from a UAE free zone”.

At the same time, the FTA directly characterizes freelancing as business in example No. 17 in the Corporate Tax Guide “Taxation of natural persons under the Corporate Tax Law” No. CTGTNP1.

Therefore, it makes sense to mention in the service contract with the director that the provisions of legislation regulating the activities of freelancers do not apply to relations under the agreement between the Company and its Director.

15. Until 2023, a director's services were subject to VAT in the UAE. Since 2023, the VAT Executive Regulation[8] has introduced a specific exception for charging VAT on such services in cases where they are provided by individuals: ‘As an exception …, the functions of a member of a board of directors, performed by a natural person appointed as such, for any government entity or private sector establishment, shall not be considered a supply of Services’.

The FTA in paragraph 1.1 of the Director Service VAT Guide (2020) stressed that ‘employees who perform services for their employer are not considered to be making a taxable supply. However, taxable persons who provide independent director’s services to other legal entities would be considered to be making a taxable supply of services…’.

The FTA here interprets the term “independent”, which is used both in determining corporate tax and for VAT: ‘Any activity conducted regularly, on an ongoing basis and independently by any Person, in any location, such as industrial, commercial, agricultural, professional, vocational, service or excavation activities or anything related to the use of tangible or intangible properties’.[9]

Thus, the FTA considered a director's activity independent only if the director is an employee of the company, which means that he is not independent in relation to it.

In Bahrain, the National Bureau for Revenue con-siders this issue differently. In its Public Clarifi-cation “VAT and Directors’ Fees”, the NBR clari-fies:

In Bahrain, the National Bureau for Revenue con-siders this issue differently. In its Public Clarifi-cation “VAT and Directors’ Fees”, the NBR clari-fies:

‘Board members and directors are considered to be instruments of the entity they represent when carrying out their core duties in their capacity as board members or directors. On this basis, they are not considered to be independent from the entities concerned. Hence, a board member is not regarded as carrying on an economic activity in relation to that activity, and remuneration for services as a board member is outside the scope of VAT’.

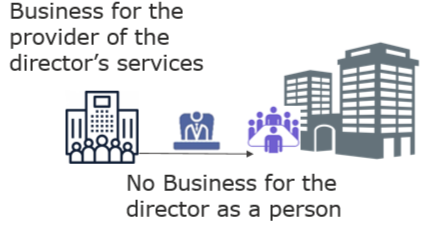

The NBR recognizes the following activities of companies representing di-rectors as independent and entrepreneurial: ‘A third party who, as part of its business and in consideration for a fee or similar payment, offers a ser-vice whereby it acts or arranges for another person to act as a board mem-ber will be considered to be acting independently. Such a third party may be a trust or company service provider, a law firm or accounting firm. Where the third party provides this service, it is considered to be engaged in an economic activity and may be required to register (if not already regis-tered) and to account for VAT on the services provided’.

It turns out that the NBR does not recognize the activities of a director selling his services on his own as independent under any circumstances. He has the same status as an employee retained by multiple employers.

|

|

In contrast, the FTA believes that such activities can be considered independent only if employees, that is, executive directors, carry them out. Therefore, in Bahrain, such services are exempt from VAT without a special exemption to this effect in the VAT Law, and in the UAE they are exempt only through such a special exemption.

The fact that UAE VAT legislation contains an exemption of this nature, but Corporate Tax legislation does not, creates Corporate Tax exposure for those directors who do not have an employment contract with the same company.

16. The above allows us to conclude that the features distinguishing a director's Business Activity from non-business activity are not clearly defined. That is why the FTA reiterates the case-by-case formula.

In such a case, it makes sense to ensure in a real life situation that as many features as possible are present from the case that have already been resolved by the FTA. This case is quoted above in full. It is possible to bring a situation closer to it by means of entry into an employment contract with the same director in addition to a service contract. For this purpose, an additional position can be referred to, for example, senior manager. Such a manager can be assigned all the features that are not required for the position of a director. Accordingly, most of the remuneration will be set by this contract and should be safe.

It will be reasonable to present the service contract in such a way that it can be used as proof that the director's activity is not independent. At the same time, references to the service contract may be made in the employment contract, for example, in terms of applying its provisions to the service contract to an extent that does not contradict the terms of the latter, etc. Special provisions of the service contract that bring it within the definition and features of an employment contract detailed in the ADGM Employment Regulations 2019 may also be included therein.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.

The Acknowledgment

This study has benefited from the contributions of the following people: Peter Brophy, Legal Editor and solicitor advising on English law, for his remarkable editing job; and Varvara Gunko for her assistance in the research.

[1] Art.19(1).

[2] Art. 19(5).

[3] Art. 16.

[4] Art. 7(2).

[5] The ADGM Standard Employment Contract.

[6] Sec. 3.6 of the Corporate Tax Guide “Taxation of natural persons under the Corporate Tax Law” No. CTGTNP1.

[7] The ADGM regulator provides its justification for this in the Guidance Note – Employment in ADGM (a part of the Legal Framework section).

[8] Par. 2 of Art.3.