Introduction

Corporate tax has been put into application in the United Arab Emirates starting from 1 June this year. The first tax period for Emirati companies will be the first calendar year or a 12-month period after 1 June for which financial statements are drawn up (articles 57 and 69 of Federal Decree-Law No. 47 (2022) “On the taxation of corporations and businesses” (the “Law on Corporate Tax”)). For most companies, the first tax period will be 2024, and business does not have much time left to prepare for the corporate tax regime in the UAE.

Business has been expecting for a long time that the new corporate tax will not affect companies registered in Free Zones. Article 3(2)(a) of the Law on Corporate Tax stipulates that Qualifying Free Zone Persons will pay tax on Qualifying income at a zero rate. However, the document which was put for public consultation as early as 2022 (the ‘Public Consultation Document’) anticipated that Qualifying income will include all income that Free Zone Persons will earn from (1) transactions with companies that are located in the same or another Free Zone, and (2) transactions with companies outside the UAE. A business that is registered in a Free Zone but does not provide services and/or carry out trade transactions with mainland companies would, therefore, have taxed at a zero rate the whole income it has generated.

In early June, the Ministry of Finance issued decisions (Cabinet Decision No. 55 dated 30 May 2023 and Ministerial Decision No. 139 dated 1 June 2023) whereby it determined the list and criteria of income which may be recognised as Qualifying income of Free Zone Residents. The approach that the Ministry of Finance has chosen for levying taxation on Free Zone Persons has ultimately turned out to be very different from what taxpayers expected. For instance, the Ministry of Finance equated income from transactions with companies outside the UAE to the income earned from transactions with mainland companies. The Ministry of Finance specifically draws attention to this matter on its website in the section FAQ - https://mof.gov.ae/corporate-tax-faq/ (see Question 150)

In addition, the Ministry of Finance has determined a small number of Qualifying activities from which income is classified as Qualifying income irrespective of with whom a Free Zone Resident that obtained the income carries out its activity, namely: whether it is a Free Zone Person, a foreign partner or a mainland company.

Therefore, it will become impossible for the majority of businesses registered in Free Zones to apply the 0% rate. Meanwhile, those Free Zone Residents who meet the criteria relating to Qualifying income will have to closely monitor any receipt of non-qualifying income because any amount in excess of the threshold established for such income by the Cabinet will deprive them of the opportunity to apply the 0% tax rate to all income for 5 tax periods.

Qualifying Free Zone Person

Article 3(2) of the Law on Corporate Tax stipulates that only Qualifying Residents of Free Zones may apply the 0% tax rate. Therefore, we need to first get to grips with which Free Zone Persons fall under this definition.

The Law on Corporate Tax defines a Free Zone Person as a legal entity that is incorporated or established under the rules and regulations of a Free Zone, or a branch of a mainland UAE or foreign legal entity that is registered in a Free Zone. A foreign company that transfers its place of incorporation to a Free Zone in the UAE, for instance in case of redomiciliation, would also be considered a Free Zone Person.

As for natural persons, unincorporated partnerships and sole establishments, they will not be able to benefit from the Free Zone Corporate Tax regime because they do not fall under the definition of ‘Free Zone Person’. Nor will a foreign company be able to take advantage of this regime if it became resident of a Free Zone solely based on the place of effective management (PoEM) in the Free Zone. https://mof.gov.ae/corporate-tax-faq/ (Question 125)

To become a Qualifying person a Free Zone resident must comply with a number of conditions for which article 18(1) of the Law on Corporate Tax provides and as additionally prescribed by the Minister, namely:

- maintain an adequate substance in a Free Zone;

- derive Qualifying Income as specified in a decision issued by the Cabinet;

- elect not to be subject to Corporate Tax;

-

comply with Articles 34 “Arm’s Length Principle” and 55 “Transfer Pricing Documentation” It is worth noting that article 55 of the Law on Corporate Tax provides that a tax authority may request disclosure from a taxpayer to be submitted together with the tax return describing in detail transactions with dependent and related parties. The FTA is still to establish the form of such ‘disclosure’. Members of a multinational enterprises group with consolidated revenues of AED 3,150 million and more for the tax period and companies in the UAE whose revenues that are taken into account for profit tax purposes amount to AED 200 million and over must have transfer pricing documentation (a master file and local file) at their disposal (Ministerial Decision No. 97 dated 27 April 2023).

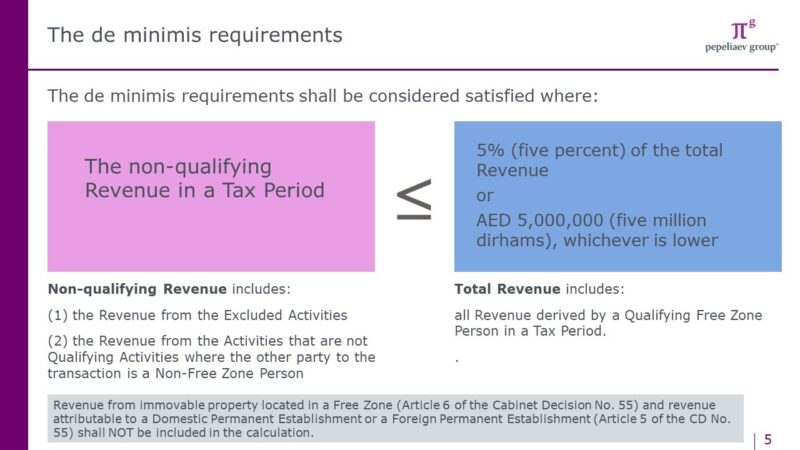

- comply with the de minimis requirements: non-qualifying revenues of a Free Zone Person should not exceed 5%

of the total revenue during the tax period or AED 5 million whichever is lower; This and the following condition are provided for not by article 18 of the Law on Corporate Tax but by article 5 of Ministerial Decision No. 139 of 2023.

- prepare audited financial statements.

Non-compliance with any of the above conditions will deprive a Qualifying Free Zone Person of its status, and starting from the relevant tax period and for 4 subsequent tax periods such Person will be unable to enjoy the benefits of a preferential tax regime. Article 5(2) of Ministerial Decision No. 139 of 2023.

Qualifying Income

As already stated, Qualifying Free Zone Person will be able to apply the 0% tax rate only in relation to a Qualifying income (article 3(2)(a) of the Law on Corporate Tax). The elements of Qualifying income have been established by Cabinet Decision No. 55 dated 30 May 2023 and Ministerial Decision No. 139 dated 1 June 2023. To figure out how rules relating to ‘Qualifying income’ which are stipulated by the above decisions should be applied, the best thing is to divide all income that a free zone resident earns into several ‘pots’:

- the first ‘pot’ should hold all income of the free zone resident which relate to the activities of its permanent establishment abroad or on the UAE mainland (domestic or foreign permanent establishment).

The tax rate of 9% will apply to such income (article 5 of Cabinet Decision No. 55) irrespective of whether a free zone resident meets other conditions for a ‘qualifying’ resident or whether the revenues which are attributable to permanent establishments exceed 5% or AED 5 million of the total revenues in the tax period. Revenues that relate to permanent establishments are not taken into account for the calculation of the de minimis requirements, and, therefore, it may be significantly higher than 5% or AED 5 million. However, a Free Zone Person will not lose its right to apply the preferential corporate tax regime.

To determine whether a Free Zone Person has a permanent establishment on the mainland, one should follow article 14 of the Law on Corporate Tax: “Permanent Establishment”. Article 3(5) of the Cabinet Decision No. 55 of 2023 Consequently, even if a Free Zone person does not have a registered branch on the mainland, it may still have a permanent establishment. An example is a situation when a free zone person has a fixed or permanent place on the mainland through which its business activity is conducted.

In its answers to questions, the UAE Ministry of Finance clarifies that it is not required to register as a separate taxpayer the permanent establishment of a Free Zone Person that is located abroad or on the mainland https://mof.gov.ae/corporate-tax-faq/ (Question 163); it will be sufficient to report the amount of income which relates to such permanent establishment in the tax return of the Free Zone Person and pay the tax;

- the second ‘pot’ may hold income from transactions with Free Zone residents (both the Free Zone where the taxpayer itself is registered and all other Free Zones in the UAE).

The rate of 0% will apply to such income (article 3(1)(a) of Cabinet Decision No. 55) provided that all other requirements for a ‘qualifying’ resident are complied with by the Free Zone Person. The Cabinet expressly prescribes that income from Excluded activities should be excluded from such income and, hence, it should be put into a different ‘pot’. As regards the tax rate which will apply to such income (from Excluded activities), we will discuss this below.

Article 3(2) of Cabinet Decision No. 55 contains a reservation that income will be deemed to have been received from transactions with a Free Zone Person only if such person is a beneficial recipient of a product or a service. This means that a Free Zone Person which acquires a product or a service is entitled to use and consume them individually and has no contractual or other legal obligations to transfer such service or product to another person.

In its answers to questions, the Ministry of Finance clarifies that income from a transaction with a Free Zone Person will also be deemed Qualifying income in a situation when such person (a counterparty with whom a Qualifying Free Zone Person enters into a transaction) is not a ‘Qualifying’ person and does not apply the preferential tax regime for Free Zone residents; https://mof.gov.ae/corporate-tax-faq/ (Question 144)

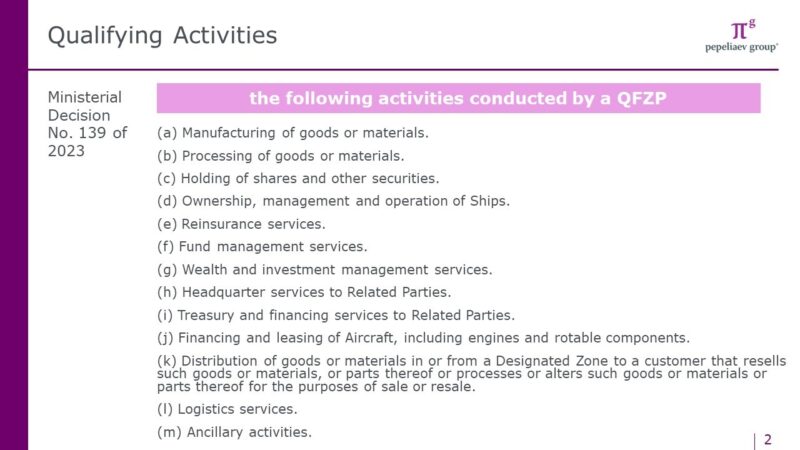

- a Free Zone Person may put income from Qualifying activities into the third ‘pot’. Ministerial Decision No. 139 provides for a list of such activities (see picture 1). In relation to such activities, it is irrelevant from whom a Free Zone Person received income: it might be a Free Zone resident, a foreign counterparty or a mainland counterparty. Such income will also be subject to the 0% tax rate (article 3(1)(b) of Cabinet Decision No. 55); although income from Excluded activities will have to be preliminarily excluded from such income.

As regards Qualifying activities, heated public discussions are now taking place. The discussions deal with how the substance should be determined of activities that the Ministry of Finance classifies as Qualifying activities.

Here are some examples.

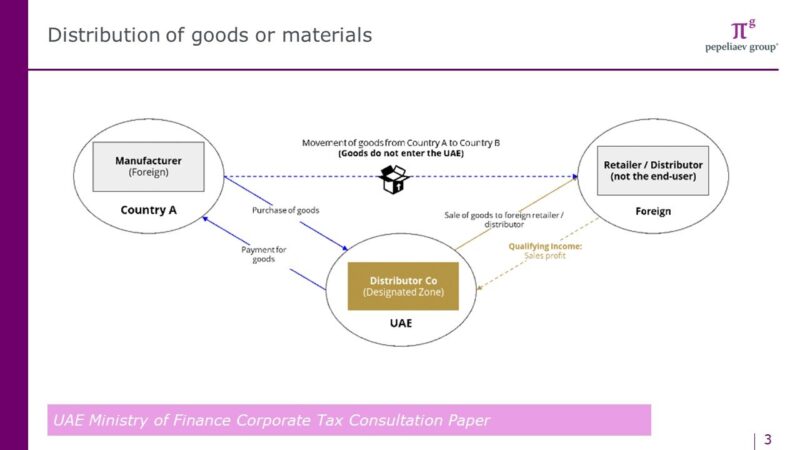

Example 1. Distribution of goods or materials (article 2(1)(k) of Decision No. 139).

Article 2(3) of Ministerial Decision No. 139 clarifies that the activity of distributing goods or materials must be undertaken in or from a Designated Zone and the goods or materials entering the State must be imported through the Designated Zone. If this provision is interpreted literally, it seems that only those Free Zone Person may qualify for the tax benefit that distribute products via the Designated Zone, namely: they import the product into that territory and then either export it abroad or import it into the mainland. Strictly speaking, even such an interpretation is extremely broad as the provision does not say anything about exporting a product into another country, but only mentions importing it into the mainland. Hence, in literal terms, qualifying activity should be deemed to be only such distribution of goods or materials under which goods are imported into the Designated Zone and are then imported from the zone into the mainland.

However, another approach has been reflected in the Public Consultation Document where examples are given of Qualifying and Excluded activities. https://mof.gov.ae/free-zone-public-consultation/

On the chart, the Ministry of Finance showed a company that is registered in the Designated Zone and distributes goods from a foreign producer to a foreign buyer, where such goods are directly transported from a foreign country into another foreign country, avoiding the UAE and the Designated Zone (see picture 2). Income that was received from the distribution of the goods by avoiding the UAE and the Designated Zone is described as ‘Qualifying’ income in the document.

Although it has been pointed out in the notes to the Public Consultation Document that it is released only for input to be obtained from interested parties and does not reflect the final view of the legislature, it is likely that this approach will be preserved in the final official position of the Ministry of Finance.

Other questions also remain open. May a distributor qualify for a benefit if it has been registered in a free zone (other than the Designated Zone) but distributes goods in the Designated Zone? For example, if goods are imported into the Designated Zone, the resident will be deemed to carry out other key activities of such type in that zone, such as accept orders, store the goods, transport and perform inventory management (let us suppose that an outsourced contractor will perform such functions). Will income from such activity be deemed Qualifying income? Another question that business is concerned about is the status of the Designated Zone. Will any free zone that is a Designated Zone be classified, for VAT purposes, as the Designated Zone for corporate tax purposes? Will any separate list of such zones appear?

Example 2. 2. Manufacturing of goods or materials (article 2(1)(a))

The big news in the Consultation Document is the interpretation of “Manufacturing”.

The MoF proposes that:

- full-fledged manufacturing be distinguished from contractual manufacturing,

- the whole profit of a contractual manufacturer be taxed at 0%;

- profit of a full-fledged manufacturer be split into two parts:

a) profit from manufacturing which is subject to the 0% tax rate, and

b) profit from sale (distribution) which may be taxed at the 0% rate only if the sale is made from a designated zone for subsequent sale.

Decision No. 139, which has introduced Qualifying Activity for the purposes of applying the 0% tax rate, does not allow for such interpretation. ‘Manufacturing of goods or materials’ and ‘Processing of goods or materials’ both qualify for the 0% Corporate Tax rate but under separate paragraphs.

Most obvious is what method is to be used to allocate the profit of a fully-fledged manufacturer between manufacturing and distribution.

What functions will be treated as manufacturing features and which as the attributes of distribution activity? Where a distributor and fully-fledged manufacture are different persons, a great number of functions may be allocated between them according to the contract. Is it worth singling out the sales department and relocating it from a regular free zone to the designated one? What form will be better used for such separation: a branch or separate entity? Which positions and assets should be relocated?

Example 3. Ancillary activities (article 2(1)(m) of Ministerial Decision No. 139)

Under article 2(4) of Ministerial Decision No. 139, such activity, for the purposes of applying clause 1(m) of this article, should be considered ancillary if it serves no independent function but is necessary for the performance of the core activity. Further, article 3(4) of Cabinet Decision No. 55 dated 30 May 2023 also stipulates that Qualifying income will include income obtained from any person if such income is incidental to the income earned from the activity that is recognised to be Qualifying activity under Ministerial Decision No. 139.

For example, let us imagine a Free Zone resident who manufactures industrial equipment in that zone. Within the scope of warranty repairs of the equipment, it replaces spare parts free of charge, but, upon the expiry of the warranty period, it sells spare parts that it does not itself manufacture. Please be reminded that the distribution of goods other than in or outside the Designated Zone does not constitute Qualifying Activity.

Taken as a whole, these two provisions prompt the conclusion that, for such Free Zone Person, the sale of spare parts constitutes ancillary activity or incidental income. Therefore, even if such income exceeds 5% or AED 5 million (the de minimis requirements), the taxpayer will not be deprived of its right to apply the preferential corporate tax regime;

- a separate fourth ‘pot’ will have to hold all other revenues which do not fall into the category of income from transactions with Free Zone Persons, income from Qualifying activities, income from Excluded activities and income from a domestic or foreign permanent establishment.

The rate of 0% will apply to such income (article 3(1)(c) of Cabinet Decision No. 55) if a Free Zone resident meets the de minimis requirements, namely if its Non-Qualifying revenue does not exceed 5% of total revenue or AED 5 million during the tax period;

-

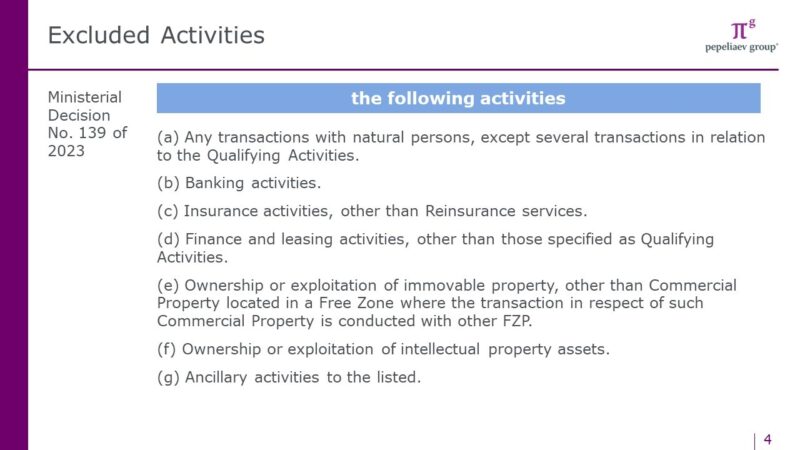

Текст здесь текст тултипаincome from Excluded activities has been mentioned on several occasions in other clauses. This income will need to be put into a different fifth ‘pot’. Ministerial Decision No. 139 provides for a list of Excluded activities (see picture 3). Income from such activities will not be treated as Qualifying income even if it was obtained from another Free Zone resident.Текст здесь текст тултипа

The Public Consultation Document, which was mentioned above, also contains examples with a breakdown by types of Excluded activities. Let us consider the two most interesting examples.

Example 1. Income from any transaction with individuals, except for certain transactions related to Qualifying Activities (article 3(1)(a) of Ministerial Decision No. 139).

The list of Excluded activities includes all transactions with individuals other than those related to: the ownership or operation of ships; fund management services; capital and investment management services; and the financing and leasing of aircraft. Moreover, if a Free Zone resident complies with the de minimis requirements, it may also obtain income from natural persons (Excluded activities) and will not be deprived of its right to benefit from a preferential tax period.

Example 2. Income from the ownership or use of intellectual property assets (‘IP’) (article 3(1)(f).

The Finance Ministry clarifies that royalty, licence payments and other separately identifiable IP assets such as patents, copyright and trademarks constitute income from Excluded Activities . https://mof.gov.ae/corporate-tax-faq/ (Question 153)

This means that even if a Free Zone Person obtains such income from other Free Zone residents, the former will not be eligible to benefit from the 0% corporate tax rate.

For more details regarding this type of Excluded activities, please refer to the above-mentioned Public Consultation Document. https://mof.gov.ae/free-zone-public-consultation/

Thus, in relation to the income that is identified separately, the Public Consultation Document explains that income derived from the use of IP assets which are somehow used for the development of either a product or a service and for which no separate payment is made should not be classified as income from Excluded activities.

One example is a situation when a manufacturer in a Free Zone manufactures and sells to consumers products that are labelled with a trademark. The value of products labelled with the trademark includes an embedded value of an IP asset. Moreover, no separately identifiable income from IP assets is mentioned in the above scenario.

However, unresolved issues still remain, with one of them being: should Free Zone Persons that provide software as a service (SaaS), infrastructure as a service (IaaS) and virtual platforms as a service (PaaS) be treated as enterprises engaged in the sphere of intellectual property (carrying out Excluded activities for the purposes of applying the 0% tax rate)?

There is also uncertainty regarding the rate that should be applied to income from Excluded activities. The wording itself of article 3(1) of Cabinet Decision No. 55 allows for a double interpretation. Option one: the rate of 9% always applies to income from Excluded activities since paras ‘a’ and ‘b’ of the above clause underline that the 0% rate applies to income from transactions with Free Zone residents and to income from Qualifying activities, except for income from Excluded activities. Option two: the 0% rate should apply to such income since it does not exceed the de minimis requirements. This option of interpretation is also permitted by the structure set out in article 3(1) of Cabinet Decision No. 55 which says that the 0% rate applies to all types of income other than income stated in paras ‘a’ and ‘b’.

In its clarifications the Ministry of Finance does not give a straightforward answer. In reply to the question: “What is the corporate tax treatment of income derived from Excluded activities?” the Ministry of Finance states: if income derived from Excluded activities exceeds the de minimis requirements, this will result in a person being disqualified from the corporate taxation regime of a free zone. https://mof.gov.ae/corporate-tax-faq/ (Question 147)

The Ministry of Finance does not offer any clear answer to the question of which rate should be applied to the revenues that do not exceed de minimis requirements;

- the last sixth ‘pot’ should hold income from the ownership or exploitation of immovable property.

The rate to be applied in relation to such income will depend on whether or not immovable property constitutes commercial property and who is a party to the transaction: either a Free Zone resident or another person. If a Free Zone Person earns income from commercial property under a transaction with another Free Zone resident, then the 0% tax rate may be applied with respect to such income.

When it comes to income from a) transactions relating to commercial property that are closed with persons who are not Free Zone residents, and b) transactions relating to immovable property that is not commercial property which are closed with any person, such income will be subject to the rate of 9%.

Although income specified in the last paragraph is expressly classified as income from Excluded activities (article 3(1)(e) of Ministerial Decision No. 139), such income should be considered separately. First, such income is not taken into account when the de minimis requirements are assessed (article 4(3) of Ministerial Decision No. 139). In other words, a Free Zone resident may obtain more than 5% of its revenues from immovable non-commercial property and will not lose its eligibility to apply the preferential tax regime. Second, the rate which applies to such income has been clearly determined. The rate will always be 9% (articles 6(1) and 3(1) of Cabinet Decision No. 55) even if the de minimis requirements have been complied with. Here is evidence of the current ambiguity in relation to the tax rate with respect to other income from Excluded activities.

In the Public Consultation Document, the Ministry of Finance clarifies how to deal with immovable property which is used in a mixed manner, namely: one part of such property is classed as commercial premises, while the other is classed as residential premises. In such a situation, a company will apply the 0% tax rate to a portion of income from the use of such property and 9% to the other portion of income and separately account for the expenses associated with the use of the property.

Adequate substance

One of the conditions that a Qualifying Free Zone Person must comply with to be eligible for the 0% corporate tax rate is to maintain an adequate level of substance in the Free Zone.

The meaning of the requirement is set out in article 7 of Cabinet Decision No. 55, whereby a Free Zone Person must:

- undertake its core income-generating activity (CIGA) in the Free Zone;

- have adequate assets that are necessary for the relevant activity to be performed in the Free Zone;

- have an adequate number of qualified employees who work in the Free Zone;

- incur an adequate amount of operating expenditures.

The Cabinet’s Decision allows for the core income-generating activity to be outsourced to a related party or a third party in the Free Zone (article 7(2) of the Decision) provided that the Free Zone Person exercises adequate supervision over such activity.

An adequate level of substance must be maintained not simply in the UAE but in the Free Zone where the company has been founded or registered or in another Free Zone.

In reply to the question of how compliance with this condition will be assessed, the Ministry of Finance states that the assessment will depend on specific circumstances and will be conducted on a case-by-case basis, taking into account the nature of a Free Zone resident’s activity and the income it earns as well as other relevant facts and circumstances. https://mof.gov.ae/corporate-tax-faq/ (Question 138)

It should be noted that currently rules have been introduced at the federal level for the ‘relevant’ activities in the UAE Cabinet Decision No. 57 (2020) and the Ministry of Finance’s Decision No. 100 (2020) which impose an obligation to meet the substance requirements in the UAE.

Such relevant activities include: banking; insurance; the activity of investment fund management companies; the lease-finance business; the activity of headquarters; the shipping business; holding company business; using results of intellectual activity; distributing products acquired from other companies of the group; and service centre business. If a Free Zone person undertakes relevant activities, it must also file annual notifications and reports to confirm compliance with the economic substance requirements.

It is still unclear whether a similar obligation will be established for Free Zone Persons that do not conduct relevant activities. In reply to this question the Ministry of Finance states that further information regarding changes in the current rules relating to the requirements of economic substance and obligations relating to compliance with such rules by Free Zone Persons will be provided in due course https://mof.gov.ae/corporate-tax-faq/ (Question 140)

Complying with the de minimis requirements

So as not to lose the status of a Qualifying Free Zone Person, a taxpayer must meet the de minimis requirements.

The de minimis requirements will be complied with if the non-qualifying income of a Free Zone resident for the tax period does not exceed 5% of the total revenues or AED 5 million (for more details on how the de minimis requirements are assessed, please see picture 4). It is important, however, that income assigned to the first and sixth pots, or more accurately revenues from such activities (from a permanent establishment which is located on the mainland or abroad and from the ownership and operation of immovable property) are not taken into account when the de minimis requirements are assessed.

Here is an example.

A company that is a Free Zone resident earns revenues from the operation of immovable property of which 30% is used as commercial premises and 70% as residential premises. The Free Zone resident obtains revenues from operating the property from other residents of Free Zones in the following proportion: AED 3 million for commercial property and AED 7 million for residential property.

The company also has a branch on the mainland that offers consulting services to other mainland companies and earns revenues in the amount of AED 1 million.

The company itself provides consulting services to companies in its Free Zone or in other Free Zones, earning revenues of AED 10 million, as well as to foreign counterparties, earning revenues of AED 1 million. It also provides headquarters services to related parties (coordinates subsidiaries in the Gulf, conducts strategic management and advises subsidiaries on all emerging operating matters) and earns revenues of AED 6 million.

Let us assess whether the company meets the de minimis requirements.

Revenues from operating residential premises (AED 7 million) and revenues earned by the branch on the mainland (AED 1 million) will not be taken into account in the calculations; therefore, income from such activities will be subject to the 9% tax rate.

Revenues from commercial immovable property (AED 3 million) and consulting services (AED 10 million) are classed as Qualifying revenues as they correspond to article 3(1)(a) of Cabinet Decision No. 55, namely these are revenues from transactions with Free Zone residents. Revenues from headquarters services (AED 6 million) will also be Qualifying revenues as they correspond to article 3(10(b) of Cabinet Decision No. 55 and article 2(10(h) of Ministerial Decision No. 139 and constitute revenues from Qualifying activities. Hence, Qualifying revenues stood at AED 19 million.

Only AED 1 million which was earned from foreign counterparties for consulting services may be classified as Non-Qualifying revenues. The company’s total revenues for the tax period amount to AED 20 million, where AED 1 million of Non-Qualifying revenues constitutes 5% of the total revenues. Therefore, the de minimis requirements are complied with. The 0% tax rate may also be applied in relation to income from foreign counterparties (article 3(1)(c) of Cabinet Decision No. 55).

Registration for corporate tax purposes

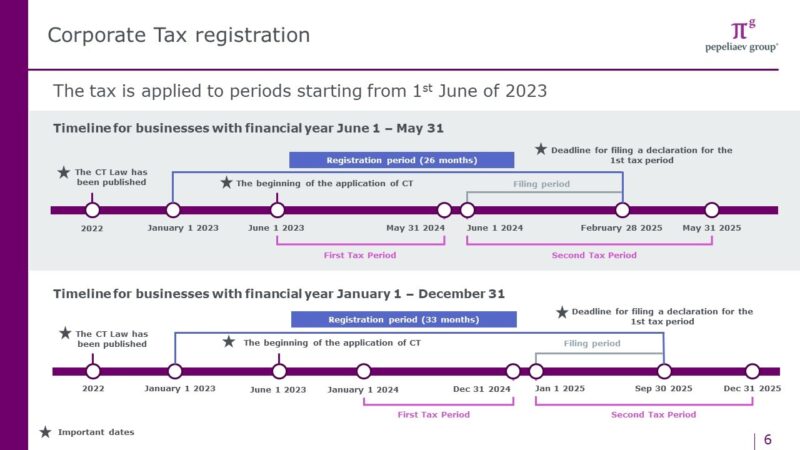

Free Zone residents are payers of corporate tax; therefore, similarly to all other taxpayers, they should be registered for the purposes of corporate tax irrespective of whether they are Qualifying Free Zone Persons or not and whether they intend to benefit from the preferential tax regime.

Such registration should be performed before the date on which tax returns are filed for the first tax period. For a company whose financial year is equal to a calendar year, registration must be put in place before 30 September 2025.

During registration a taxpayer is not required to choose the preferential regime of corporate tax; this will be applied automatically if a Free Zone Person complies with the conditions of a Qualifying Free Zone Person. If a Free Zone Person cannot meet such conditions it becomes an ordinary taxpayer of corporate tax. In that case, the taxpayer may benefit from the preferential regime for small businesses; it may form a tax group and benefit from intra-group relief, business restructuring and an intra-group transfer of assets. A Qualifying Free Zone Person has no such possibilities as expressly provided for in the Law on Corporate Tax.

How much will an error cost?

On 10 July 2023, the Cabinet adopted Decision No. 75 regarding administrative fines for offences relating to the corporate tax. The Decision came into effect on 1 August. The Ministry of Finance continues working on the rules relating to the corporate taxation regime. And although fines for violations relating to the payment of corporate tax which have been published are currently lower than the fines relating to the payment of excise duties or VAT, companies will have to ensure compliance with all provisions of the Law on corporate tax.

How much will an error cost to a taxpayer?

Let us say that a Free Zone Person calculated its income for 2024, which amounted to AED 100,375,000. The Free Zone Person thought that it was complying with all conditions for a Qualifying resident and was meeting the de minimis requirements and, hence, applied the 0% tax rate to the whole of its income. In September 2025, the taxpayer filed its tax return where it stated 0 as its tax due (the tax fell due on 30 September). Six months later the free zone person realised that it had made an error in assessing the de minimis requirements and should be applying the 9% rate to all of its earned profits. In March 2026, the taxpayer files an adjusted tax return (Voluntary Disclosure) and indicates in it AED 9 million in taxes (the first AED 375,000 is not subject to tax; we multiply AED 100 million by 9% and derive AED 9 million).

According to Cabinet Decision No. 75, a Free Zone Person must pay:

- a) a fine for voluntary disclosure in relation to the errors made in the tax return in the amount of 1% of the tax difference per month to be calculated starting from the date on which payment was due and until the date of the voluntary disclosure (6% for the period from October 2025 until March 2026 inclusive);

-

b) a fine for the late payment of the tax in the amount of 1.2% per month or part of it (7.2% for the whole period of the delay); On 14 October 2020, the Federal Supreme Court of the United Arab Emirates held that voluntary disclosure entails not only a fine being imposed for an error in the tax return and a special fine for the ‘tax benefit’ owing to the tax being declared late when the tax return is adjusted individually but also a fine for ‘delayed payment’. The latter fine is applied not from the date on which the period expires for the tax to be paid under the adjusted tax return (20 days after an error was disclosed) but from the date established for the tax to be paid under the original tax return. The judgment was issued in relation to VAT. However, it interprets legal provisions which are identical, in terms of the wording, to the rules established in relation to corporate tax. Therefore, there are no reasons to hope that a different approach will be applied in relation to corporate tax.

- c) a fine in the amount of AED 500 for submitting an incorrect tax return.

The taxpayer will pay AED 1,188,500 (13.2% of AED 9 million plus AED 500) in total. If it identifies its errors within a year, the fines (except for the fine for filing an incorrect tax return) will be doubled; if it identifies them in 2 years’ time the fines will be 4 times as much, and so on. The maximum amount of an administrative fine for a tax offence in the UAE may reach (but may not exceed) 200% of the amount of outstanding taxes (article 25 of Federal Decree-Law No. 28 of 2022).

Therefore, a Free Zone Person who intends to apply the 0% tax rate should be extremely careful in complying with all the conditions, in assessing the de minimis requirements and in its income being compliant with Cabinet Decision No. 55 and Ministerial Decision No. 139.