The facts

A Group has trading companies set up in regular (non-financial) free zones.

All these companies are licensed for trading only and supply goods to the foreign companies of this group to resell them.

To cover several zones in one study, zones under the supervision of Dubai Integrated Free Zone Authority are taken:

- the Dubai Silicon Oasis,

- the Dubai International Airport Free Zone,

- the Dubai CommerCity

These UAE companies are going to give loans to the foreign companies of the same group.

The questions

-

Is it legal for there to be interest on such loans?

-

How to determine the interest rate for such loans to comply with the Arm’s Length requirements?

The summary

-

An interest bearing commercial loan between legal entities is legal in the UAE;

-

In our opinion, a special license is not required for such loan if it is given not ‘by way of business’. A lender may fall within the scope of this exemption if it links the loan to a trading operation. You may find pertinent recommendations below in the analytical part of this Case Study.

- The authorities may challenge this exemption.

This risk may be mitigated by linking the loan to the trading activity of the lender and setting a limit of 12 months for the loan.

The risk may be eliminated by replacing the conventional loan with interest to be paid due to:

- an unauthorized delay in payment or

- as a credit to compensate the agreed payment in installments.

-

Linking trading with loan exposes interest to be included in the custom value. This may entail additional assessment of import custom duty in a country of destination.

- The Group may also consider using a financial free zone ADGM or DIFC. to provide a loan. For example, a company in the ADGM may without a financial license:

- provide intra-group interest-bearing financing, and

- enjoy the 0% Corporate Tax rate on interest,

- mitigate risk of the dispute on inclusion of interest in custom value.

- The lending company may establish the arm’s length rate by obtaining a proposal for deposit from an independent UAE bank where it has bank accounts. As an alternative, the lender may use information from its online internet banking personal account.

The analysis

Civil Issues

Civil Issues

Article 72 of the Commercial Transactions Law Federal Decree-Law No. 50/2022 ensures that:

- ‘the creditor shall have the right to charge interest on the commercial loan as per the rate stated in the contract.

- If the interest rate is not determined in the contract, it shall be calculated as per the interest rate prevailing in the market at the time of the transaction. However, in this case, the rate shall not exceed (9%) per annum until full payment’.

If there is agreement on the interest rate in the contract, and the debtor is in default of payment, default interest shall be calculated on the basis of the agreed rate until the full payment (Art. 73).

Interest shall be paid at the end of year, if the term of loan is one year or more, or on the maturity date of debt, if the period is less than one year, unless a commercial custom or banking practice otherwise provides (Art. 74).

These rules allow concluding that interest-bearing loans between legal entities are legal in the UAE.

Licensing and Regulatory Issues

Licensing and Regulatory Issues

Dubai Law No. (16) has aggregated the zones mentioned in the Facts section into the list of Integrated Economic Zones that were to be governed by Dubai Integrated Economic Zones Authority (DIEZA). The aggregation has had effect since 2022.

Article 6 of the Dubai Law No. (16) authorises DIEZA to do the following:

- ‘Determining and regulating the businesses and activities authorised to be practiced in the Integrated Economic Zones, and setting the rules, conditions, requirements and procedures necessary for licensing such businesses and activities.

- Registering and licensing companies, institutions and other entities within the Free Zone, in accordance with the provisions of this Law and the decisions issued thereunder’.

Article 4(b) of this Law sets out that ‘these zones shall be subject to the administration and legislative regulation of the Authority, provided that the decisions of the Chairman issued in this regard are published in the official gazette of the government’.

As per Article 21, ‘the Authority or the Licensed Institutions with respect to their operations within the Free Zone shall not be subject to the legislation related to Dubai Municipality or the Department of Economic Development, or to the authorities and powers within the jurisdiction of any of them, with the exception of legislation related to health, public safety, environment, and food control as well as the legislation expressly stipulating the application of the provisions within the Free Zones’.

On the other hand, Article 15(b) obstructs the trading of ‘goods, services and products that are prohibited from being traded in the State in accordance with the applicable legislation’.

Article 23 of this Law provides that:

- ‘no person or entity may engage in any activity in the Free Zone, unless it is licensed to do so by the Authority.

- Institutions shall be licensed to operate in the Free Zone, and all the rules regulating their work, including their establishment and registration, determination of the conditions and rules governing them, laying down regulations for their liquidation, and any other matters related to them, according to a special system approved by the Chairman in this regard’.

Article 3 of the DIEZA Implementing Regulations 2023 envisages that:

Article 3 of the DIEZA Implementing Regulations 2023 envisages that:

-

Federal Law No. (32) of 2021 Regarding Commercial Companies does not apply to a Company or a Branch operating in Integrated Free Zones.

-

The relevant Markets Laws are applicable to a PLC: ‘The applicable Markets Laws prevail over these Regulations to the extent of an inconsistency between the Markets Laws and these Regulations’“Markets Laws” are defined as ‘the securities laws and relevant regulations applicable to a PLC listing its Shares on a stock exchange, in the jurisdiction where the stock exchange is established’..

Regulation 20.1 of the these Regulations stipulates that ‘a Company or a Branch Parent Company operated through a Branch may only conduct the activities that are permitted under its Licence’. Regulation 20.5 authorises DIEZA to ‘in its discretion vary the terms or conditions of a Licence at any time’.

As per the facts of this Study, The licences of the companies authorise the conduct of trading. Neither of these types of activity features interest-bearing loans.

Therefore, the companies may not refer to the licenses to justify such activity.

Financial Assistance

Financial Assistance

Intragroup ‘financial assistance’ is addressed in Regulation 35.2, according to which such assistance ‘includes making a loan, making a gift, issuing a debenture, giving security over the PLC’s assets or giving a guarantee or an indemnity in respect of another person’s liability’.

This term is disclosed for the purpose of Regulation 35.1 which stipulates that ‘a PLC or a company that is a Subsidiary of it may not provide financial assistance to a person to acquire Shares in the PLC, or to acquire Shares in a Holding Company of the PLC, unless’ there are situations specified in these Regulations. In other cases, such prohibition is not effective. This rule allows it to be deduced that:

- such financial assistance is allowed in cases where a loan is not targeted at acquiring shares, and

- a loan may be treated rather as a form of financial assistance than as activity to be permitted (licensed).

Therefore, the use of this wording (financial assistance agreement, the Borrower agreed to provide financial assistance in form of a loan, etc.) may mitigate the license-related risk. This will allow the contract to be linked to the favorable provisions of the Regulations 35.1 and 35.2.

Loan as an ‘incidental part of some larger purpose’

Loan as an ‘incidental part of some larger purpose’

Para (e) of Regulation 35.1 mentions ‘financial assistance’, which ‘is only an incidental part of some larger purpose of the PLC and … given in good faith in the interest of the PLC’.

We think that this concept may be employed in the loans agreements at hand to link loans with licensed activity. The parties may:

- name the parties as the Supplier and Buyer,

- use other wording linking loan and supplies,

- mention that the Supplier provides Financial Assistance in the form of a loan to assist the Buyer to boost resales, i.e. to increase the volume of goods resold by the Buyer and eventually increase the volume of sales of goods according to the existing sale and purchase contract between the Parties.

Regulatory risks

Regulatory risks

However, Regulations 35.1 and 35.2 do not specify an interest-bearing loan. Therefore, there’s a risk that the Authority may treat a loan as assistance only where such loan is interest free.

Article 2 of Dubai Law No. (13) of 2011 ‘Regulating the Conduct of Economic Activities in the Emirate of Dubai’ defines a License as ‘a document authorising a Business to conduct an Economic Activity’:

| Translation in Lexis Middle East |

Translation uploaded on the web-site of Dubai Economy Department |

| The latter is defined as ‘any commercial, industrial, professional, occupational, agricultural, service or any other activity aiming at achieving profit and allowed to be practiced in the Emirate, according to applicable legislations’. | Any commercial, industrial, artisan, occupational, agricultural, service, or any other for-profit activity authorised in the Emirate in accordance with the legislation in force. |

This Law may not be applied directly to Dubai Free zones. Art. 2 determines business as ‘any company or sole proprietorship licensed to conduct an Economic Activity in the Emirate, excluding businesses licensed in free zones’. However, we believe it may still be applied as zone’s regulations don’t have another definition of ‘economic activity’.

An interest-bearing loan aims to generate profit. Therefore, it may be treated as for-profit activity. This exposes the lending companies to the risk of a claim that such activity shall be licensed to be conducted within Integrated Free Zones.

Regulation 44.3(c) clarifies: ‘For avoidance of doubt, financial assistance does not include … financial assistance by the Company where the business of the Company is to provide finance and the financial assistance is given in the ordinary course of that business and on ordinary commercial terms’.

This rule implies that financial assistance performed by way of a business providing finance shall not be treated as non-licensed financial assistance. The authorities may add it to the arguments based on definition of Economic Activity cited above to prove that the Lending companies provides loan in a way of business which shall be specifically licensed.

Mitigation of Risk

The above-mentioned amendments in the loan agreement may mitigate this risk as they support:

- the concept of the ancillary nature of the loan (auxiliary to trading activity, which is already licensed), and

- its subordinate position to the larger (already licensed) purpose.

‘By way of business’ Option to Mitigate Risk

Besides, the lending company may refer to the definition ‘by way of Business’ in the regulations.

We haven’t managed to find a definition of ‘by way of business’ disclosed either in the DIEZA’s regulations or at the federal level. Such information is found in the UAE’s prime financial free zones: ADGM and DIFC.

Para (3) of Schedule 1 to the ADGM Financial Services And Markets Regulations of 2015 determines that ‘a person carries on an activity by way of business if the person—

-

engages in the activity in a manner which in itself constitutes the carrying on of a business;

-

holds himself out as willing and able to engage in that activity; or

-

regularly solicits other persons to engage with him in transactions constituting that activity’.

In DIFC, Rule 2.3 of the of DFSA General Module (GEN) GEN/VER61/08-23 provides identical regulation.

In our opinion:

-

attribute (a) may be treated as missing if loans are provided as an ancillary part of another licensed activity, e.g. ‘trading’. Otherwise, this ancillary activity may constitute carrying on business by itself. For instance, if a company lends funds to another Group member to boost the latter’s sales and thereby the former’s own sales, such loan doesn’t constitute business separate from trading. However, if the company aggregates group cash flows and distributes them according to the needs of the group, such activity constitutes treasury business and requires the license to be extended;

-

attribute (b) may be deemed missing if intragroup loans have been provided according to an instruction received from other persons, e.g. a common beneficiary of the lender and borrower;

-

attribute (c) is missing in the case of irregular, rarely granted loans.

DIFC and ADGM are Financial Free Zones. Article 151 of the Central Bank Law doesn’t allow the application of federal legislation ‘to the Financial Free Zones and the financial institutions regulated by the authorities of these zones’. Therefore, regulations from DIFC and ADGM may not be applied directly in other free zones.

However, Article 10 of the Finance Companies RegulationCentral Bank Circular No. 3/2023 includes ‘wholesale finance, including loans to large corporate borrowers, small and medium-sized enterprises’ in the scope of the activity of a financial company. Such activity requires a special license.

Article 1.3(a) of this Regulation put this ‘Short-Term Credit activities conducted directly between Juridical Persons and not conducted by way of business’A Short-Term Credit is defined as ‘any credit which is granted to a Borrower for a period of not more than … (12) months” outside the scope of such Regulation. This makes interpretation of the term ‘by way of business’ relevant for cases of intragroup loans.

Alternative to replace loan with deferral interest

Article 84 of the Commercial Transactions Law sets out that ‘If the subject of commercial obligation is a sum of money of specific amount, at time of the creation of obligation and the debtor is in default of payment, the debtor shall pay the creditor, as compensation for delay, the interest defined in Articles (72) and (73), unless otherwise is agreed’.

Art. 1.3(b) of the Central Bank’s Finance Companies Regulation excludes from the scope of the regulated activity ‘any credit activity, whereby the payment to the vendor directly by the purchaser of a good or service is completed on an instalment basis and not conducted by way of business’.

Therefore, the parties may pick up the slack in funds without any loan:

- a delay in payment may be accompanied by interest, or

- payment in installment may be accompanied by interest.

In such scenarios, this interest is inseparable from trading activity. Thus, this option seems totally safe from the UAE licensing and regulatory point of view.

Creating a treasury in the financial free zone

Creating a treasury in the financial free zone

Risks may also be eliminated by setting up a company in ADGM (or using one already existing) for interest-bearing loan arrangements.

The ADGM’s Commercial Licensing Regulations 2015 set out a “General Prohibition”: ‘No person may carry on a controlled activity in or from the ADGM, or purport to do so, unless he is - (a) a licensed person; or (b) an exempt person’ (Art. 1).

Art. 2(2) of these Regulations set forth that ‘controlled activities specified in these Rules may be subdivided into "business activities" based on such classifications and sub-classifications as the Registrar may publish from time to time to supplement the operation of these Rules’.

The activities are classified in three categories:

-

Non-Financial (Category B)

-

Retail activities (Category C), and

-

Financial Services and Markets (Regulated Activities or Category A).

Regulated Activity is specified in Schedule 1 to the ADGM Financial Services and Markets Regulations 2015. Article 48 of this Schedule includes ‘Providing Credit’ in “Regulated Activity”: ‘Entering into a Credit Facility with a person in his capacity as a Borrower or potential Borrower is a specified kind of activity. (2) It is a specified kind of activity for the Lender or another person to exercise, or to have the right to exercise, the Lender's rights and duties under a Credit Facility’.

As per para 258 (1) of the Schedule, ‘Credit includes any Cash loan or other financial accommodation’ and ‘Credit Facility’ means ‘any facility which includes any arrangement or agreement which extends monetary Credit whether funded or unfunded to Person including but not limited to any loan…’.

However, para 49(4) determines that ‘paragraph 48 is also subject to the exclusions in paragraphs 76 and 77’. Para 77(7) excludes ‘from paragraph 48 the entering into of a Credit Facility by a person if— (a) he is a member of a Group and enters into the agreement with another member of the same Group’.

On balance, intragroup loans are excluded from the list of the regulated activity. That means that an intragroup lender doesn’t fall within the scope of Category A.

Neither does a lender who doesn’t conduct retail business fit into Category C.

Category B doesn’t refer specifically to loans. However, it mentions different types of treasury licenses. The code 7031 “Treasury Cash and Liquidity Management” includes ‘Global liquidity funding and disposition’, ‘Optimizing commercial cash flows, interest expense, working capital and tax expense through netting and cash concentration’, ‘Conceptualization, development and negotiation of pooling mechanisms’.

The ADGM has released “Regional Treasure Centers in ADGM. Tax and Regulatory Analysis”, which is not binding research with all pertinent disclaimers at the beginning. However, the document is uploaded on the ADGM official web and expresses ADGM’s (non-binding) opinion. In Section 2.2.2, ADGM informs us that ‘regulations allow for a broad range of business activities, including treasury, financial services, holding and financing activities. This broad range of activities effectively allows MNCs to establish an RTC or in-house bank in ADGM and perform services typically provided by banks without being required to set up a regulated financial services entity’. Then, a list of treasury-related licenses is included through which a multinational corporation (MNC) may reach this effect.

Intragroup loans are mentioned multiple times in this document as a part of treasury activities. This guides us to surmise that the provision of intra-group loans may relate to the activities of the treasury and therefore may require regular an intra-group treasury license.

Qualification for 0% Corporate Tax rate

Qualification for 0% Corporate Tax rate

Article 2(1)(j) of the MoF’s Decision No. 265 of 27 November 2023 qualifies ‘treasury and financing services to Related Parties’ for the 0% Corporate Tax rate.

Art. 2(3)(j) of this Decision sets forth that ‘treasury and financing services to Related Parties includes the provision of cash and liquidity management, financing, debt management, and financial risk management and related advisory services to Related Parties, including centralised payment and collection activities for or on behalf of Related Parties’.

An intragroup loan qualifies for this definition as it may be named ‘financing’ or the ‘provision of cash’.

However, being combined with trading, interest falls out of the scope of the 0% Corporate Tax rate.

Indeed, the distribution of regular goods (not commodities) for resale is zero-rated only if it is conducted from a designated free zone. The Dubai Silicon Oasis and Dubai ComerCity are not in the list of designated zones Art. 2(1)(l) of the Ministerial Decision 265. . Only the Dubai International Airport Free Zone is designated. Therefore, income gained from trading from Dubai Silicon Oasis and Dubai ComerCity is not qualifying.

The share of non-qualifying revenues in total revenues may not exceed 5%. We assume that interest hardly exceed 96% of total revenues of the MIXED FZCO. Therefore, interest which can be qualified separately will be taxed at 9%, being combined with trading revenues.

If the Group sets up a separate entity (treasury), its income will not be compromised by non-qualifying income from trading. This allows the Group to apply 0% Corporate Tax on gains from financial intragroup services (loans, etc.)

This may also help lending company:

-

to deal with the regulatory and licensing risks referred above,

-

to mitigate the risk of interest being included in the custom value in the country of destination.

Arm’s Length Rate

Arm’s Length Rate

The Arm’s Length Principle, as introduced in the UAE under Article 34 of the Corporate Tax Law, requires that intragroup transactions are priced as if these transactions had occurred between independent parties under similar circumstances. It is central to the Arm's Length Principle to consider what price two independent parties would have agreed in similar circumstances, and that this should be based, wherever possible, on direct or indirect evidence of how independent parties would have behaved. This approach is also applicable to intragroup loans.

The Transfer Pricing Guide No. CTGTP1 issued by the UAE Federal Tax Authority (FTA) states that generally the most appropriate method to determine Arm’s Length Rate for an Intragroup loan is the method of Comparable Uncontrolled Price (the CUP method). According to section 7.1.3.1 of the Guide the CUP method for loans typically involves the following steps:

-

Analysis of the terms of the loan relating to factors that may impact the pricing including issue date, tenor, country of the borrower, currency, options, interest rate type (for example, fixed vs. floating), etc.;

-

Analysis of the borrower’s credit rating to understand the credit risk borne by the lender in extending the loan;

-

Search for third-party loans with a similar credit rating and terms;

-

Comparability adjustments if necessary and the calculation of the arm’s length range.

However, when a lender is making a loan to an associated borrower, it will not necessarily follow all of the same processes as an independent lender. For example, the information about the borrower’s business may already be available within the group and it will help to understand the credit risk for the borrower. At the same time an independent lender considering the issue of a loan to the borrower will evaluate not only various factors relating to the borrower, but also other options realistically available to the lender for the use of its funds.

The appropriate rate may be established by investigating the alternative options for depositing cash.

To have appropriate evidence, the lending company may request a client-tailored proposal for deposit from an independent UAE bank where the company has bank accounts.

As an alternative, the Company may use information from its online internet banking personal account.

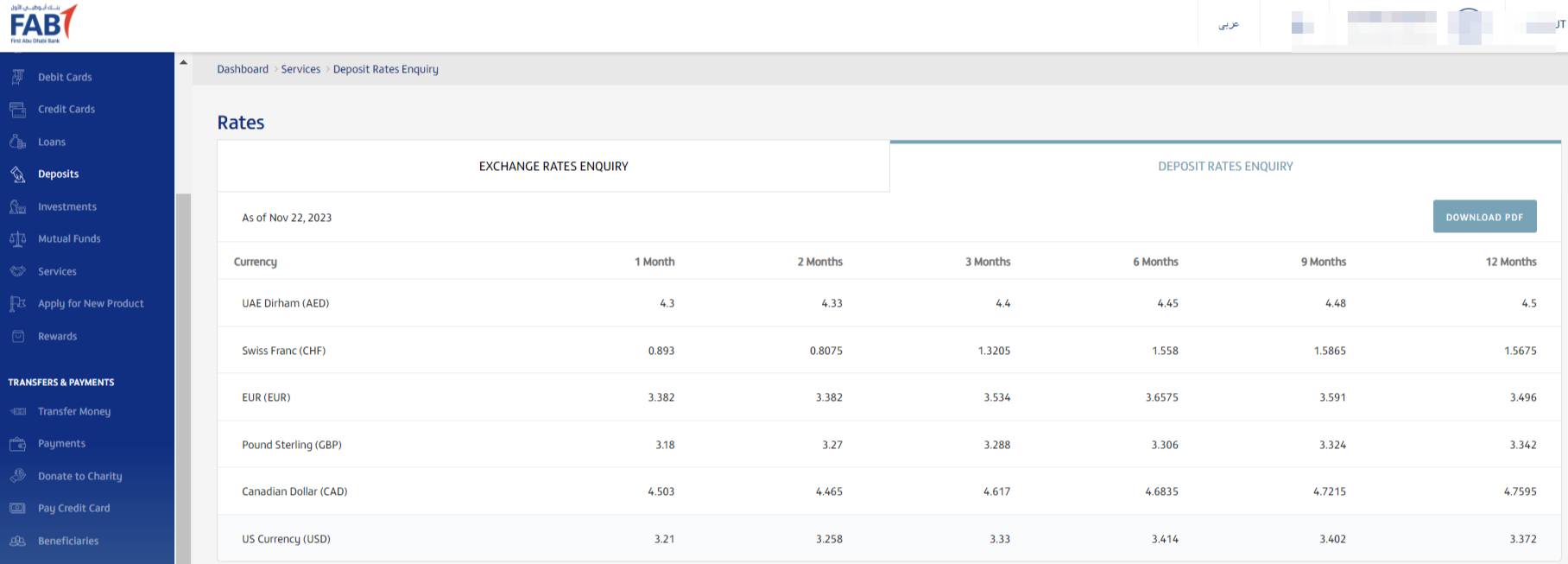

For example, First Abu Dhabi Bank allows one to a download pdf with deposit rates, e.g.:

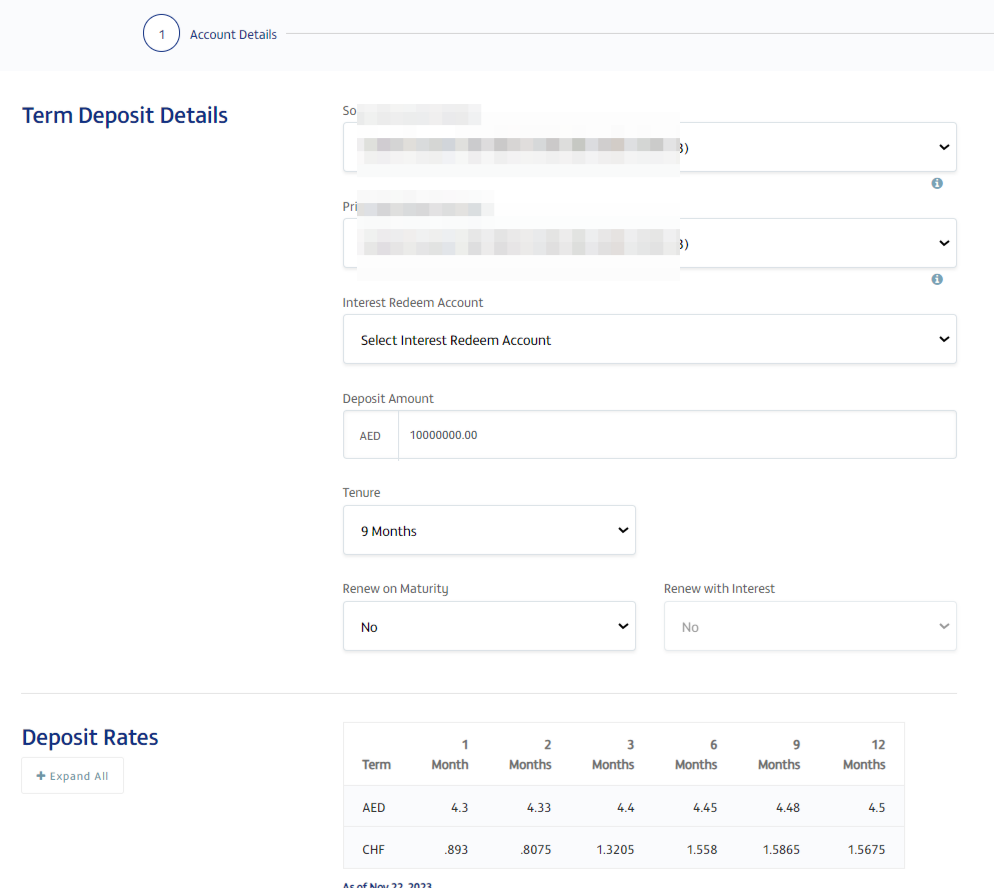

Or tailored to the Client’s information:

The disclaimer

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.