The institute of a tax assessment review has been launched by Art. 28(1) of the new Law on Tax ProceduresUAEFederal Decree-Law No. 28 issued on 30 Sep 2022.

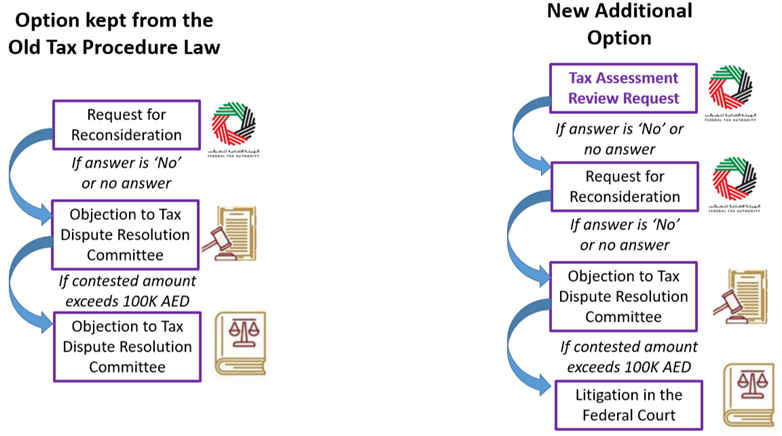

(the “New Tax Procedures Law”), i.e. it is applicable from March 1, 2023. It has added an optional tier, a new opportunity to have a tax assessment dismissed or decreased. Previously a taxpayer could only file a reconsideration request with the FTA to challenge an assessment. This filing was (and continues to be) an obligatory step to pass the dispute to external institutions (the Tax Dispute Resolution Committee (TDRC)Art. 32 (2) (a) of the New Tax Procedures Law.

under the jurisdiction of the Ministry of Justice and federal courtsArt. 33 (4) of the New Tax Procedures Law.

).

Now, prior to lodging a tax assessment reconsideration request a taxpayer may request the FTA to review an assessment. If the FTA issues a negative decision after the review, the taxpayer is in a position to request a reconsideration of this decision. If the FTA doesn’t issue its decision within the timeline allowed, the taxpayer may request the reconsideration of the initial decision (assessment).Art. 28 (4) and Art. 29 (3) of the New Tax Procedures Law.

The form and manner for a request haven’t been specified. May a taxpayer plead for a review?

Article 29(5) of the New Tax Procedures Law sets forth that a request to review ‘shall be made in the form and manner specified by’ the FTA.

However, the Law has already been in effect for six months, and such form and manner are still not specified. The FTA’s e-service portal also offers the reconsideration option only. I haven’t found any clarification on new tool from the FTA or MoF.

How to proceed in such case? Does the taxpayer have the right to submit a request in any reasonable form and in any reasonable manner?

Clause (1) of the same article vests a tax person with the authority to request a review. Clause (3) obliges the FTA ‘to review the request made under Clause 1 of this Article and issue a decision’. Clause 6 requires that a ‘request submitted under Clause 1 of this Article shall be made in the form and manner specified by the Authority’. Under Article (4) of the Federal Decree-Law No. 13/2016 “On the Establishment of the Federal Tax Authority” ‘the Authority shall assume the following duties: (1) Management, collection and implementation of federal taxes and associated fines, the distribution of their revenues, and the application of the tax measures in force in the State, and for this purpose, it shall do the following:

- Application of laws and regulations with respect to federal taxes and associated fines’ (sub clause (a));

- ‘Issuance of guidance and clarifications deemed necessary for the taxpayer with respect to the limits of his federal tax and associated fines obligations, in accordance with the mechanisms established by a decision of the Board’ (sub clause (i)).

Clause 5 of Article 60 of the UAE Constitution sets forth that ‘the Council of Ministers, in its capacity as the executive authority of the Union, … shall, in particular, … issue regulations necessary for the implementation of Federal laws without amending or suspending such regulations or making any exemption from their execution…. By special law provision or by decision of the Council of Ministers, the competent Federal Minister or any other administrative authority may be charged to issue some of these regulations’.

It’s clear from rules quoted above that the FTA is obliged to issue a regulation on the form and manner for the submission of a tax assessment review request. The absence of such regulation may not freeze the rule of the law. The required regulation may circumscribe the forms and manners of requests. The absence of a circumscribing regulation means that a tax person is free to choose the form and manner.

Indirectly, this position is confirmed by the UAE Federal Supreme Court’s Ruling for case No. 674 of 2008, UAE 674/2008 (heard on June 16, 2008). The Federal Supreme Court found that if the Justice Minister does not issue a decree to establish the committees envisaged in the relevant law to adjudicate a dispute prior to a federal court, litigants may plead before the competent court directly. The situation is in part similar here. The decision from the state body is still to be issued. The absence of this decision may not deprive the taxpayer of its right to have his review request adjudicated by the Governmental body specified by the Law.

What could be a reason to opt for a review first?

It’s not clear enough what the pros and cons may be in requesting a review (مراجعة) prior to requesting a reconsideration (إعادة النظر). The terms used have the same meaning in both languages, at least in the context of evaluating objections to the assessment.

Both instruments have similar features:

After a negative outcome of the review, an applicant is in position to request a reconsideration. A taxpayer may request a reconsideration without having previously requested a review.

So, why should you opt for a review first? Why not request a reconsideration directly?

What is clear?

Let’s try to draw up a summary of what is clear.

First, the deadline for submission and the deadline for consideration. They are the same as for a request for revision:

-

the request shall by lodged within 40 business days ‘from the date the Person is notified of the Tax Assessment and the related Administrative Penalties’ plus 5 days to notify the taxpayer on the decision;Art. 28 cl. (2), Art. 29 (1) of the New Tax Procedures Law.

-

The FTA may extend the deadline for deciding on each request by 20 business days;Art. 28 (1) of the Executive Regulation on New Tax Procedures Law, Cabinet Decision No. 74 of 10 July 2023)

-

A request shall be considered and decided within 40 business days, after which the FTA shall ‘inform the applicant of its decision within (5) five Business Days from the date of issuing the decision’.Art. 28 cl. (3), Art. 29 (2) of the New Tax Procedures Law.

The second thing that is clear is that a review may not be requested if a tax person has filed a reconsideration request first.Art. 29 cl. (5) of the New Tax Procedures Law.

If a request for review has been filed and a decision on it has not yet been made, then you can submit a request for a reconsideration. However, for this to happen, the 40-day deadline set for a review must expire. In this case, the FTA should terminate the review by switching to considering the request for a review.Art. 28 cl. (5) and 29 (3) of the New Tax Procedures Law.

You might assume that a request for a review is compulsory for a subsequent appeal of a tax assessment. However, this assumption is refuted by two rules:

- Art. 28(1) of the New Tax Procedures Law provides that ‘a Person may submit a request to the Authority to review a Tax Assessment or part thereof and any related Administrative Penalties’ ‘without prejudice to the provisions of Article 29’ ‘Request for consideration’;

- Art. 29(2) of this Law determines that ‘it shall not be permissible to submit a request for reconsideration of a Tax Assessment if a request for review is submitted to the Authority in this regard until a decision is issued by the Authority…’. This wording unambiguously determines that an assessment is allowed to be reconsidered if a request to review is not filed.

At last, you may assume that a request to review is to be applied at the pre-assessment stage, hence it’s a remedy to prevent an incorrect assessment. This assumption is also wrong. Art. 29(1) of the New Tax Procedures Law provides that ‘a Person may submit a request to the Authority to reconsider any decision, or part thereof’. Article 1 of this Law defines Tax and Penalty Assessments as a ‘decision issued by the Authority’. Hence, an assessment, which is subject to review, may not come up without a decision being already issued.

It is reasonable to assume that a review shall differ from a reconsideration in some way. Otherwise, it doesn’t make sense to do the same exercise twice.

Let’s try to figure out how these two remedies (review and appeal) should work to be effective.

The principal goals of an administrative review

Let me quote the World Bank Group (2013) Toolkit ‘The Administrative Review Process for Tax Disputes: Tax Objections and Appeals in Latin America and the Caribbean’: ‘An effective administrative review process is not only less costly than an appeal to the courts, but is often a taxpayer’s only realistic chance to be heard’.

The OECDOECD (2013) Tax Administration: Comparative Information on OECD and Other Advanced and Emerging Economies Tax Administration 2013.

and World Bank break down the purposes of an administrative review as:

1) speeding up the process of redressing taxpayer grievances, i.e. saves time and money,

2) easing the caseload faced by tax courts,

3) affording taxpayers the opportunity to have inaccurate tax assessments revised and errors redressed without the burden of litigation.

According to the World Bank Handbook on Tax SimplificationWorld Bank, Handbook on TaxSimplification, 2009, p. 131.

‘the general objective of the internal tax review … is to provide a credible, independent and timely resolution to taxpayer objections’.

The mission statement of the Appeals Office of the US Internal Revenue Service determines its mission as: “to resolve tax controversies: without litigation, on a basis which is fair and impartial to both the Government and you, and in a manner that will enhance voluntary compliance and your confidence in the integrity and efficiency of the Service. Independence and impartiality are our most important core values, because our independence protects our ability to make objective and impartial decisions

A well-organized internal review process also offers important advantages for the government:

4) It can enable the tax authorities to swiftly identify and correct mistakes at a minimal fiscal and administrative cost and without the need to involve the judicial branch,

5) It strengthens the integrity of the tax administration

6) It strengthens public confidence in the tax system and reduces opportunities for corruption and abuse.

As per the OECD (2013) Tax Administration guidelines, the internal review process has three main objectives, which each country may prioritize differently:

| ‘Internal tax-review procedures should resolve tax disputes in a timely and less expensive manner than courts of law. These objectives can be accomplished by minimizing procedural rules, allowing informal communication within the tax authority and with the taxpayer, and adopting a flexible approach to dispute resolution that focuses on achieving mutually agreeable outcomes’ | |

| ‘The review process should give the tax authority an opportunity to evaluate its own systematic accuracy and administrative capacity. The primary purpose of the tax authority is not to maximize revenue collection, but to apply tax laws correctly. The internal review process can help the authorities ensure equal treatment of taxpayers, identify and correct recurring errors, reduce corruption, and enhance the overall quality of tax administration’ | |

| ‘a well-designed process for administrative tax review should reflect and address the unique constraints of the national legal system. For example, in cases where judicial procedures are particularly slow, the efficiency of the internal review process should be emphasized. In cases where litigation is especially expensive, the internal review process should focus on serving lower-income taxpayers. In cases where judgments are inconsistent and uncoordinated due to differences in the efficacy of local court systems, a centralized internal review process can provide a vital measure of consistency and predictability’ |

How internal review works in the rest of the Gulf

Let’s check whether other countries in the Gulf have two tiers of internal appeals and how it works if they do.

Oman

Oman’s VAT LawOman Sultani Decree No. 121/2020, Articles 88, 89, 91 and 92.

, Income Tax LawOman Sultani Decree No. 28/2009, Articles 160, 161, 166 and 168.

and the Excise LawOman Sultani Decree No. 23/2019

vest taxpayers with a right to appeal decisions to the chairman of the tax authority. The next stage is to appeal against the decision by the chairman to a Committee whose members are not employees of the tax authority.

So, the system has many features similar those in the UAE except for the 2 stages of the internal review. Oman has only one stage but the UAE now has 2 stages.

Qatar

Article 17 of Qatar Income Tax Law No. 24/2018 authorizes ‘the taxpayer to object to the tax assessment decision... The objection shall be submitted to the’ General Tax Authority’ (GTA). If a taxpayer doesn’t agree with the decision issued by GTA regarding his objection, he may file a grievance with the Tax Appeal Committee, whiсh although it is ‘established at the Authority’, is ‘presided by a judge from the Court of Appeal selected by the Supreme Judicial Council’. That, possibly, is why the specialists refer to Qatar as ‘a one-tier system for tax review that allows taxpayers to object to a decision of the General Tax Authority and obtain an administrative review. However, the applicable Tax law in Qatar does not allow for further appeals within the tax administration’.

Kuwait

In Kuwait, an appeal and objection chapter is included in the Executory Regulations for Kuwaiti Income TaxImplementing Regulation to Law No. (2) of 2008 Amending Some Provisions of the Kuwaiti Income Tax Decree No. (3) of 1955, Kuwait Ministerial Decision No. 29/2008

. Article 24 grants a taxpayer the right to object against an assessment letter to the Department of Income Tax (DIT). Article 26 allows a taxpayer ‘file an appeal against the rejection decision issued by the Tax Administration before a Tax Appeals Committee’.

According to Article 26 of Executive RuleExecutive Rules and Instructions of the Kuwait Income Tax Decree were issued on 12 Dec 2013 with Kuwait Administrative Decision No. 875/2013.

No. 58, the decisions of the Committee ‘shall be issued by the majority votes after deliberations of the panel. In the event of a tie, the side with which the chairman has voted with shall prevail. The decisions shall be signed by the chairman of the Committee and approved by the Director of the Inspection Tax Claims Department’. Article 27 provides the opportunity to both the DIT and the taxpayer to appeal against a decision of the Tax Appeals Committee before the competent court.

This system is more likely to be classed as a one-tier internal review level due to the distance in responsibilities between the chains of the management of the DIT and the Tax Appeal Committee.

Bahrain

In Bahrain the National Bureau for Taxation (NBR) ‘shall issue its decision to assess the Net Tax’ (VAT)Art. 49 of the VAT Decree-Law No. 48/2018 and Art. of the Executive Regulations of the VAT Law (Decision No. 12/2018)

. However, ‘administrative fines may be imposed by a decision of the Minister [of finance – AN] or his authorised delegate, which includes the amount of Tax due’.Art. 60 of the Bahrain VAT Law

The administrative fines ‘shall be collected with the amount of Tax due’.Ibid, last paragraph.

Article 62 of the Bahrain VAT Law permits ‘a Person against whom a decision has been issued to impose an administrative fine’ to ‘file an objection to the Tax Appeals Review Committee’. This Committee ‘shall issue its recommendation on the objection … and shall submit its recommendation to the Minister or his authorized delegate. The Minister or his authorized delegate shall issue his decision to approve, amend or cancel the recommendation within fifteen days from the date its receipt’. The same procedure is set in Article 66 of this Law.

However, in practice, the decision of the NBR is to be reviewed by the Internal Review Section of the NBR before the case is escalated to the Committee. Thus, if a taxpayer disagrees with all or part of a decision from the NBR, the taxpayer must first request that the NBR conduct an internal review of its decision.VAT Technical FAQs, Section11.

As per Article 66 of this Law, after the Committee’s review ‘the concerned party may appeal to the competent court against the decision of the Minister …’.

The Tax Appeals Review Committee ‘shall be formed with a head, whose grade is not less than director at the Bureau, and at least five other members with experience in tax, finance, accounting and legal matters’. KPMG reported that at the first session of this Committee9 March 2020.

its members ‘are distinguished in their field of expertize who are not part of the NBR’. They took part in the hearing ‘in addition to NBR representatives’.

So, in practice Bahrain has one level of an internal review within the NBR and one level of a mixed review where an independent view on the assessment is raised to the level of the superior (the Minister of the Finance or his authorized delegate).

The Kingdom of Saudi Arabia

Saudi Arabia is different. In the Kingdom, ‘any person to whom a decision is issued by the Authority may file an objection against’ it to the Zakat, Tax and Customs Authority (ZATCA). If a decision is issued rejecting the objection or if no decision is rendered by the deadline, ‘the Taxpayer may perform … request to transfer the objection to the Internal Committee for settlement’. The next level is to file a grievance lawsuit against the decision of the Authority before the Settlement Committee’. Unlike in the UAE, the taxpayer may skip the level of the Internal Settlement Committee and ‘file the grievance lawsuit directly before the Settlement Committee’.Art. 2 of the Saudi Arabia Functioning Rules of the Committees for Tax Disputes and Violations Settlement adopted by the Royal Decree No. 26040 on 3 January 2020.

So, here we may see 2 tiers of review within tax authority, as in the new tax procedure in the UAE. Both countries allow a taxpayer to skip one. However, the KSA allows the second stage (Internal Settlement Committee) to be skipped while the UAE treats first stage (review request) as optional.

How it works in Saudi Arabia

As we established earlier, the KSA has 2 tiers of the review within tax authority which is similar to the UAE now. Let’s examine how it works inside ZATCA.

The Assessments and Examinations department is responsible for audit and assessment. Objections are to be considered by the Review and Objections Department of ZATCA. The Internal Dispute Settlement Committee is the next (optional) stage of the internal review.

Here we may see that objections and an appeal against the result of their consideration are to be considered by different teams within ZATCA. Thus, you may expect independence. However, in practice, ‘typically, but not necessarily, this department will rule on the relevant dispute following the objection department’s decision… There is no official procedure for settlements with ZATCA. There is the Internal Disputes Settlement Committee, which has no apparent independence from the tax authority, and may therefore not necessarily adopt an objective view despite its presumed individuality from the assessment and objection teams…’.

So, interaction between the tiers of internal objection in the Kingdom is yet to be improved to serve as best practice for the UAE. It doesn’t make sense to spend funds for the 2nd tier for a mere repetition of a ruling issued by the first tier. The subject for improvement is to be found through the examination procedures within the Authority.

What should serve as best practice to make both tools work

As we found above, the lack of ‘apparent independence’ and ‘official procedure’ are proposed as the most probable cause for the Internal Disputes Settlement Committee in the KSA to support a decision issued on previous stage. We may see that the mere establishment of the unit doesn’t entail true independence. However, what does help?

The pre-requisites for the success of tax assessment reviews conducted by tax authorities are as follows:

The processes of both tiers of a tax review shall be governed by formal administrative rules.

The lack of this feature is obvious for the UAE review process. The form and manner for filing a request for review, required by Cl. 6 of Art. 28 of the Tax Procedures Law, haven’t yetbeen issued.

The FTA has established a Reconsideration Committee to handle Reconsideration requests. I haven’t found administrative rules governing its work. The FTA Annual Report for 2017-2018 advises that this Committee has been created by the decision on its establishment, according to which it assigns an auditor of its choice to examine accounts, books and records related to the contested decision to provide the Committee with an audit report. The Committee also has the right to discuss the results of the report with the auditor and request additional information from the applicant for reconsideration.

This information is not enough to assess ‘the legality of the review process’ even for the reconsideration tier.

As per the World Bank’s recommendations, the FTA’s policymakers shall ‘consider whether the legal and regulatory frameworks …adequately limit arbitrary or capricious actions, and whether they provide both the substance and appearance of justice’.

Moreover, ‘regulations that govern the tax-review process should be clearly distinguished from those that govern the assessment of tax liability. The legislation should also clearly separate operational and administrative rules, and it should avoid inconsistency and redundancy’.

The World Bank found that ‘some tax administrations may be empowered to establish internal review processes without the need for new legislation’. The FTA is in such a position, as you may see from the provisions of Law on Establishing the FTA quoted above.

We may presume that all these recommendations are factored in, in the FTA’s internal regulation. However, this doesn’t help a tax person to figure out the difference in the 2 procedures to be conducted by the FTA and adjust its appeal according to this difference. Thus, promulgating the regulation on this issue would be extremely helpful.

Independence implies ‘the administrative distance between the office that made the original decision and the office charged with reviewing that decision'.

The World Bank ranged 3 potential options in terms of independence:

- ‘No independence’ is offered ‘where a tax official review his or her own decision’. Therefore, ‘while the same institution that issued the original tax assessment may also be in charge of the review, no assessment should be reviewed by the same agent who made it’World Bank (2019) Tax Assessment Review Toolkit, page 33.

. - A moderately independent process ‘involves a review by the official’s immediate superior, though both would still exist within the same administrative hierarchy’.

- ‘Greater independence’ offers ‘the creation of a separate objection unit within the tax authority’.

The Reconsideration Committee in the FTA falls within the category of a system offering ‘greater independence’. The FTA may:

- create one more unit to consider tax assessment review requests. Such a unit probably already exists. The FTA’s Annual Report for 2018-2017 informs us of an ‘audit of 29 cases transferred from the Revenue Committee’Page 15, Clause 3

, or - assign the review to an immediate superior ‘within the same administrative hierarchy’, or

- offer other options which factor in the FTA’s structure, e.g. if there are several independent auditors’ units within Tax Compliance and Enforcement Department, each with its own superior in charge, one auditor’s unit may be assigned for the review of an assessment issued by another auditors’ unit.

However, in the example above, the FTA should reckon with actual rather than theoretical ties and dependencies between the units. Indeed, the systems, which have proved their efficiency in Canada, the UK, Germany, Australia, Singapore and Hong Kong, represent a wide range of internal review processes. The diversity of these systems ‘underscores the extent to which there is no single “right way” to establish an internal tax-review process’. Therefore, ‘an appropriate legal framework must reflect each country’s unique legal tradition and institutions’.The World Bank’s Tax Assessment Review Toolkit, page 28

For example, in some countries due distance is facilitated by rules governing contact between the original agent and the reviewer. The Appeals Office of the US Internal Revenue Service has regulations limiting the interaction between the assessing unit and the review unit.

In Latin America and the Caribbean (LAC)State of the Tax Administrations inLatin America: 2006-2010, IDB 2013, p. 238.

:

- some countries conduct initial tax reviews within the same department that issued the decision, but by a different officer or specialized unitBrazil, Chile, Colombia, Dominican Republic, Guatemala, Mexico, Nicaragua, Paraguay, and Peru

: ‘Though the public servants tasked with the review report to the same managers as those who made the initial decision, the review process is designed to provide a different perspective of the issue in question’; - others conduct a review in the same department by the immediate superior of the official responsible for the initial decisionSt. Kitts & Nevis (Comptroller) and Antigua & Barbuda (Commissioner) in the Caribbean and Argentina, Costa Rica, Ecuador, Honduras, Mexico, Panama, and Uruguay in Latin America.

; - a third group has established a special unit for objections that reports to a different deputy commissioner or commissioner than the tax-assessment unit.

The United States is within third model. The Office of Appeals operates within the Internal Revenue Service but is independent from the IRS Examination and Collection functions.

As per Box 2.1 of the World Bank Administrative Review Process

: ‘In general, the more bureaucratic distance between the officer who issued the original decision and the one who reviews that decision, the greater the credibility of the process’.

The Objections and Review business line in the Australian Tax Office (ATO) requires QC 44422, last modified: 4 May 2023

that the reviewer must not have had any prior involvement in the case being reviewed.

Where needed, the reviewing officer can contact the original decision maker or other ATO officers involved in the original decision making to better understand the facts and reasons behind the decision including where new information is raised. The officials previously involved:

The officials previously involved:

- ensure the relevant case records are up to date and complete

- explain the basis of their decision when required to do so by the reviewing officer

- ensure that information they give the reviewing officer is fair, objective and supported by evidence

- are available to the reviewing officer for meetings with the tax person or his representatives where needed

Otherwise the original agents must not initiate contact with the reviewer.

In the UK, HMRC internal manual “Appeals reviews and tribunals guidance” (ARTG) sets out that, in the course of a ‘statutory review’ exercised by the HMRC in the UK, ‘you will have your tax decision reviewed by someone at HMRC who was not involved in the original decision’.

As per ARTG4310, the reviews ‘must … be carried out by review officers. Review officers have experience of the subject matter of the appeal but are independent of the decision maker and the decision maker’s line management. This allows the review officer to remain as objective as possible”.

Shifting this experience to UAE soil, the FTA has to secure independence in two separate procedures: review and reconsideration. Thus, a request for a reconsideration is then filed against the decision on a tax assessment review request, and there are two decision makers which decisions are contested. Therefore, lines of management for both shall be identified to secure impartial consideration of the reconsideration request.

Transparency ‘reflects whether a taxpayer can easily obtain key information on the review process’. Highly transparent tax-review systems provide ‘clear, easily accessible information on the steps involved in the review process’. This includes ‘a user-friendly description of their rules and procedures’. In addition, ‘tax authorities should provide regular updates on the status of each taxpayer’s objection or appeal’.

In the above-mentioned example with the Australian Tax Office’s (ATO) review procedure, all ‘communication protocols govern the contact between reviewing officers and officers involved in making the original decision’. The reviewer must apprise the taxpayer of any discussions with the original decision maker and other ATO officers or independent advisors involved in the original decision, as well as any discussions of broader strategic issues relating to the case.

As far as I may judge, information on the reconsideration process within the FTA in the UAE is not accessible for taxpayers. While it is very helpful in terms on what an applicant must do and how it should interact with the FTA, the Guidance doesn’t elucidate the review process inside the FTA. Adding transparency to this internal process could guide a tax person on what to expect and enable him to adjust the content of his request according to this processes. That may both benefit the participant of the review and reconsideration processes, and improve their efficiency.

Efficiency reflects the ability of the review process to render decisions swiftly and at a low cost to both the taxpayer and the state, especially relative to the time and cost involved in pursuing a case through the court system.

However, efficiency may not be measured in time and cost without linking to the objective for which this time and these costs were spent. You may assign a review to an officer from the initial assessment team. He or she is familiar with the facts and positions, hence proceeds faster with a review. However, it is hardly an efficient choice, as its contribution to the resolution of the dispute is close to zero. Therefore, it’s worth considering such objectives in the regulations on a tax assessment review and reconsideration.

For instance, in the UK ARTG4060 determines two main goals of a review. The first one is to ‘take a fresh look at the decision, this may or may not be in the light of new evidence but must be done in an objective and balanced way’.

Pursuing this goal, ‘the review should identify:

- 'decisions that are wrong or unsound, and

- ‘decisions that we would not want to take before a tribunal’.

The 2nd goal is determined as ‘to help to resolve the dispute, this may not always be possible, but we should consider whether there is scope for negotiations and compromise. Sometimes a dispute can also be resolved by a clearer explanation of our position and the law’.

The review officer is to be guided by the criterion of the ability to defend the decision before the tax tribunal: ‘The review officer must consider whether the case is one which HMRC would want to defend at tribunal’.

If the goals to correct wrongs and prevent subsequent failure govern a review in the FTA, their completion makes unreasonable further steps in the staircase of the dispute procedure. Thus, the FTA’s regulations on the review and reconsideration procedures, which we may expect to come, should first include the goals for each procedure being summed up and KPI to measure the degree to which they are completed. The time and cost shall be ancillary tools to measure effectiveness, not the principal ones.

For example, the review officer in HMRC is governed by the Litigation and Settlement Strategy To check this, the officer shall verify:

1) Whether the facts have been established by sufficient evidence, and whether there is disagreement as to the facts?

2) Has there been an appropriate fact-finding phase?

3) Have all the relevant facts been considered in arriving at the HMRC decision?

4) Can any disagreement as to the facts be resolved?

5) Is the decision in line with HMRC guidance and policy?

6) If appropriate has technical or legal advice been sought from HMRC experts?

7) If advice has been sought does it take into account all the relevant facts and evidence?

According to HMRC, ‘if a decision fails either of the criteria above, it cannot be defended’. However, if the decision meets the criteria and the ‘review officer is satisfied that the decision is legally and technically supportable’, this doesn’t automatically ensure that the appeal will be refused. In such a scenario, the officer ‘should also consider the following factors as part of the review:

- Materiality/proportionality. On occasion, the cost to the exchequer may outweigh other factors and a decision not to defend an appealable decision may be made on that basis.

- Protectability of the contested decision, i.e. whether it is defendable at Tribunal. The case must be technically and legally correct, and there must be sufficient evidence to support HMRC’s position and view of the facts. Only in exceptional circumstances, HMRC may uphold the decision, which is defendable and based on sound supporting evidence, but the chance of litigation success is less than 50%.

- Wider implications. An appeal may raise unusual questions of law or general policy or in some other way potentially have an effect on future decisions. In those cases it is especially important to check that the policy and technical experts have been consulted and to seek their view as to whether the case is appropriate for litigation.

In carrying out the review, the review officer has a ‘ringmaster’ role. For example they may need to seek and coordinate input from a number of different areas of the Department, such as the decision maker, lawyers, and technical or policy specialists or the secretariat of the Case Board or Issues Panel.

The practices described above may serve as some guidance for national authorities to decide on whether or not they should be introduced in the territories that such authorities supervise. Plenty of factors may affect the chosen option. However, it looks crucial to make any choice with a rationale in mind. The absence of any regulation on procedures to follow makes an internal review a mere expensive decoration which defeats the purpose for which a review is established rather than helping to achieve it.

Dispute prevention and internal review

The most effective path to fair administration is to resolve a dispute before it arises, i.e. to prevent it. In the section “Dispute prevention” of the OCED 2022 Report on Tax AdministrationOECD (2022) Comparative Information on OECD and Other Advanced and Emerging Economies.

preventing disputes is cited as ‘the most effective strategy’ as ‘as disputes can be resource intensive processes’.

The provision of guidance and advice to taxpayers is not the only way to prevent disputes. Many administrations offer specific dispute prevention mechanisms. For example, since 2013, the Australian Tax Office has offered a large market independent review (LMIR) of a Statement of audit position paper. An LMIR is a pre-assessment review, which is to be conducted at a large business with turnover over 250m AUD. If a taxpayer has an audit in progress, he may request an LMIR or the ATO may offer it. ‘An independent senior officer from our Objections and Review business line, which forms part of the Law Design and Practice Group, will review the facts and technical merits of your audit position before any assessment or amended assessment is issued to you in relation to your audit. This officer won't have had any past involvement with your audit case’.ATO, ‘Large market independent review - turnover over $250m’, last modified: 31 Oct 2022 QC 26636

Indeed, in practice, the internal review becomes less effective if a specific decision with respect to tax administration is rendered since the unit or person appears before a tax authority, which is interested in the protection of its decision rather than in the correct resolution of the case. From this time, the tax revenue body has the task of separating the consideration of the appeal from the inevitable trend of bias in the same body. This is not a case where the assessment has not yet been finalized for, at this time, there’s no decision which a decision maker within the tax authority is inclined to defend.

It is impossible for the FTA or MoF to move a review envisaged in the Art. 28 (1) of the New Procedures Law to the pre-assessment stage. However, the FTA may add it to its audits voluntarily as an additional tool ensuring a correct assessment and preventing a dispute.

Warning

Pursuant to the MoF press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that the official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law.

See full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have status of the author’s opinion only. Like any human work, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.