On 25 October 2023, the UAE’s Cabinet issued Decision No. 100.This decision repeals Cabinet Decision No. 55 of 30 May 2023, replacing earlier rules determining Qualifying Income for a Qualifying Free Zone Person with new ones.

Two days later, the Minister of Finance released Decision No. 265 replacing Decision No. 139 of 1 June 2023, previously in effect, with a list of Qualifying and Excluded Activities, and a De Minimis threshold.

Both decisions shall be applied retroactively from 1 June 2023.

Earlier, income derived from the ownership or exploitation of an intellectual property was included in the list of Excluded Activities. Now, Art. 3(1)(c) of Decision No.100 qualifies “income derived from the ownership or exploitation of Qualifying Intellectual Property under Clause (1) of Article (7) of this Decision’.

In this article, we address a few of the issues in these Decisions that made the greatest impression on me.

Qualifying Intellectual Property

Article 1 of Decision No. 100 includes in “Qualifying Intellectual Property” ‘Patents, Copyrighted Software and any right functionally equivalent to a Patent that is both legally protected and subject to a similar approval and registration process to a Patent, such as utility models, intellectual property assets that grant protection to plants and genetic material, orphan drug designations, and extensions of Patent protection, but not including any marketing related intellectual property assets, such as trademarks’.

‘Functionally equivalent to a Patent’

Federal Law No. 11/2021 On the Regulation and Protection of Industrial Property Rights gives, in addition to patents, protection to the following IP rights:

-

a Utility Certificate, which is the Deed of Protection issued by the Ministry of the Economy for a creative step that is not sufficient to issue a Patent;

-

an Industrial Design, not directly mentioned in Art. 1 of Decision No.100 but has the same features as a patent;

-

a Layout Design of an Integrated Circuit. This also has not been mentioned, but its attribute seems similar to patent;

-

Undisclosed information (such as know-how).

In Ministerial Decision No. 100/2020 assets “similar” to patents are determined as those ‘that share the same features of a patent including copyrighted software, technical know-how and other similar novel, useful and protected assets)’.

Other law protects copyrights. However, functional equivalency goes beyond the Industrial Property Law. The function of a Patent is to grant an exclusive right to the inventor to be rewarded for an invention. Otherwise, anyone has opportunity to use an invention disclosed by the inventor.

Functionally, copyright works same way. The Copyrights Law Federal Decree-Law No. (38) issued on 20 September 2021 On Copyrights And Neigbouring Rights.

Functionally, copyright works same way. The Copyrights Law Federal Decree-Law No. (38) issued on 20 September 2021 On Copyrights And Neigbouring Rights.

protects results of work, which is ‘any innovative production in the fields of literature, arts, or science, of whatever type, manner of expression, significance, or purpose’.

And Art. 5 of the Industrial Property Rights Law sets out that ‘a Patent shall be awarded for every new Invention resulting from an innovative idea or improvement that constitutes a creative and industrially applicable step’. Thus, an innovative part is a feature for both patents and works.

Further, Article 49 rewards the owner of a patent with right to ‘license ... to use or exploit the right subject of the protection’. Art. 7 of the Copyrights Law grants the same right to a holder of the Author’s right who ‘may authorise the use of the work, in any manner whatsoever, namely through Reproduction, including downloading or electronic storage; acting, in any manner; Broadcasting; re-broadcasting; Public Performance or Public Communication; translation; assimilation; modification; rental; lending; or Publication in any manner, including making it available through computers, data or communication networks or any other means’.

Further, Article 49 rewards the owner of a patent with right to ‘license ... to use or exploit the right subject of the protection’. Art. 7 of the Copyrights Law grants the same right to a holder of the Author’s right who ‘may authorise the use of the work, in any manner whatsoever, namely through Reproduction, including downloading or electronic storage; acting, in any manner; Broadcasting; re-broadcasting; Public Performance or Public Communication; translation; assimilation; modification; rental; lending; or Publication in any manner, including making it available through computers, data or communication networks or any other means’.

The similarity of patents and copyrights is also corroborated by the provision of the above-cited Ministerial Decision No. 100 (2020) where ‘copyrighted software’ is determined to be similar to a patent asset.

‘Subject to a similar approval and registration process to a Patent’

Technical know-how passes the ‘patents functionally equivalent test’. However, the rights of the holder of undisclosed information are not subject to any approval or registration. Here, know-how falls outside of the scope of Qualifying IP.

Implementing the Regulation of the Copyrights Law Cabinet Decision No. 47/2022

allows the registration of works in the Copyrights Register, which ‘shall contain all dispositions with respect to rights and related data about the work itself and the author, including exclusive rights, their scope, period of use, assigned purpose, and other such dispositions that are related to the aforementioned rights’.

‘Marketing related intellectual property assets’ – excluded IP

“Marketing related intellectual property assets, such as trademarks” are excluded from the scope of Qualifying IP assets in Art. 4(1) of Decision No. 265. This is in full concert with para 38 of the Action 5 BEPS Report (2015), which stipulates that ‘under the nexus approach, marketing-related IP assets such as trademarks can never qualify for tax benefits under an IP regime’.

There’s no definition of marketing related IP in Decision No. 265. Let’s, then, find the meaning somewhere else.

Section 2.9 of the Relevant Activity Guidance, scheduled to the MoF’s Decision No. 100 of 19 August 2020 , determines ‘Marketing intangibles’ as ‘an intangible that relates to marketing activities, aids in the commercial exploitation of a product or service, and/or has an important promotional value for the product concerned such as trademarks, brands, customer lists and relationships).

The OECD’s TP GuidelinesOrganization for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD TP Guidelines) issued 20 January 2022.

gives same definition for ‘Marketing intangible’ and adds thereto: ‘Depending on the context, marketing intangibles may include, for example, trademarks, trade names, customer lists, customer relationships, and proprietary market and customer data that is used or aids in marketing and selling goods or services to customers’.

A ‘brand’ is an economic rather than a legal term. Para 38 of the IAS 38 “Intangible Assets” determines that ‘The acquirer may recognize a group of complementary intangible assets as a single asset provided the individual assets have similar useful lives. For example, the terms ‘brand’ and ‘brand name’ are often used as synonyms for trademarks and other marks. However, the former are general marketing terms that are typically used to refer to a group of complementary assets such as a trademark (or service mark) and its related trade name, formulas, recipes and technological expertise’.

As we may see, a taxpayer may lose the opportunity to enjoy the 0% Corporate Tax rate for those intangibles that standing alone are patents, software and other assets of a similar nature but aggregated together constitute a brand.

Example.

Franchising usually includes the provision to a franchisee not only of trademarks but a business model to be operated under the trademarks. This often implies the receipt of a bunch of technical know-how and rights to use auxiliary software, which standing alone could be treated as Qualifying IP Assets.

Franchising usually includes the provision to a franchisee not only of trademarks but a business model to be operated under the trademarks. This often implies the receipt of a bunch of technical know-how and rights to use auxiliary software, which standing alone could be treated as Qualifying IP Assets.

However, in this case they have no value without permission to use the relevant trademarks. Therefore, all intangibles that have accompanied such trademarks when put together create “marketing related IP”, which is disqualified for the 0% Corporate Tax rate.

It could work the same but in the opposite way where trademarks and other marketing related IP makes a minor contribution to a group of other types of IP assets provided. Where has this ‘minor contribution’ come from? Here it is in Art. 2(4) of Decision No. 265: ‘an activity shall be considered ancillary where it is necessary for the performance of the main activity or where it makes a minor contribution to it and is so closely related to the main activity that it should not be regarded as a separate activity’.

Example.

Let’s assume that the same franchising (for example, for the pizza business) agreement is concluded for a territory where a trademark has no reputation at all. Except for trademarks, the set of IP rights passed over includes unique recipes protected by patent and secret (but not patented) technology to cook pizzas.

Let’s assume that the same franchising (for example, for the pizza business) agreement is concluded for a territory where a trademark has no reputation at all. Except for trademarks, the set of IP rights passed over includes unique recipes protected by patent and secret (but not patented) technology to cook pizzas.

I think in this scenario, trademarks and technologies are ancillary to the patent. So, the qualification of patents may void the disqualification for trademarks and patents.

In all these examples, the wording of the contract and determination of the fees may matter. For instance:

-

If the contract doesn’t specify different fees for qualifying and non-qualifying intangibles provided, this should be the first argument in favor of consolidation.

-

If the contract provides for a right to use the brand and corresponding trademarks with an obligation to use certain software or patents, than such wording is more about providing marketing IP with complementary software and patents.

-

Vice versa, if the contract grants rights to use patents but under an obligation to use certain trademarks, then the IP treated as marketing is ancillary to the patents, hence both are qualifying.

Qualifying income

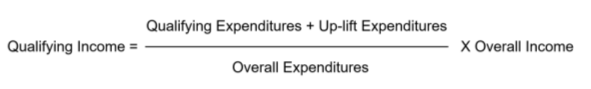

Not all income will be taxed at a zero rate, but only the part of it that is localized in the UAE. In terms of the Action 5 BEPS Report (2015), the localized part qualifying for such benefit is to be named the ‘nexus ratio’. Here is the formula to calculate Qualifying Income from IP:

-

the taxpayer's R&D costs incurred in the UAE (not necessarily in the free zones) plus those paid to independent persons abroad, are taken to be treated as Qualifying ExpendituresArticle 4(2)(a) defines 'Qualifying Expenditures' as ‘expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person in the State or any Person outside the State that is not a Related Party, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property’.

; -

an additional 130% of Qualifying Expenditures (Up-lift Expenditures ‘Uplift Expenditures” means ‘the Qualifying Expenditure increased by 30%..., subject to the application of’ the De Minimis Rule.

) are to be added to Qualifying Expenditures (but so that the total is smaller than the Overall Expenditures) to give in total 230% of the Qualifying Expenditures; -

the amount of expenses received at Step (2) is to be divided by the Overall ExpendituresArticle 4(2)(b) defines 'Overall Expenditures' as ‘total expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property, including acquisition costs of the Qualifying Intellectual Property’.

. The nexus ratio is thus obtained; -

overall Income from the corresponding IP asset is to be multiplied by the nexus ratio. This will be the Qualifying income.

Here is how it is illustrated in Art. 4(1) of Decision No. 265:

A press release from the MoF says that ‘new decisions introduce an Intellectual Property regime which follows the Organisation for Economic Co-operation and Development (OECD) modified nexus approach’. Indeed so, except for the Up-lift cost, which has to be 30% rather than 130% of the Qualifying Expenditures. Here is what the OECD says in para 40 of the Report: “When calculating qualifying expenditures, jurisdictions may permit taxpayers to apply a 30% “up-lift” to expenditures that are included in qualifying expenditures”.

Let’s employ Example A from this paragraph to illustrate the difference:

Example A: The taxpayer itself incurred qualifying expenditures of 100, it incurred acquisition costs of 10, and it paid 40 for the R&D expenditures of a related party. The initial amount of qualifying expenditures is therefore 100, and the maximum up-lift will be 30 (i.e. 100 x 30%).

Example A: The taxpayer itself incurred qualifying expenditures of 100, it incurred acquisition costs of 10, and it paid 40 for the R&D expenditures of a related party. The initial amount of qualifying expenditures is therefore 100, and the maximum up-lift will be 30 (i.e. 100 x 30%).

The taxpayer can only increase its qualifying expenditures to 130 if its overall expenditures are equal to or greater than 130. Overall expenditures in this example are equal to 150, so the up-lift can increase qualifying expenditures to 130. IP income will therefore be multiplied by 130/150 (or 86.7%).

In the UAE case, the maximum up-lift will be 130 (i.e. 100+100 x 30%) as Art. 4(2)(d) of Decision No. 265 ordains that it be computed as ‘the Qualifying Expenditure increased by 30%...’. Art. 4(1) then requires that the Up-lift Expenditure be added to the Qualifying Expenditure once again. In doing so we receive 100+130=230. However, Art. 4(3) sets forth that ‘the Up-lift Expenditures shall be applicable only to the extent that Qualifying Expenditures, after being up-lifted, are less than or equal to Overall Expenditures’. Therefore, uplifted expenses are topped by 150, i.e. in the UAE version 100% IP income is subject to the 0% Corporate Tax Rate.

It is remarkable that the general rules in Economic Substance Regulation do not allow IP businesses to place research and development (R&D) abroadArt. 3(2)(h)(a) and Art. 6(1)(a) of Cabinet Resolution No. 57 issued on 10 November 2020.

. However, this does not prevent the companies that violate these rules from applying a zero rate in the UAE. If all candidates for the 0% rate must carry out core income generating operations (CIGAs) in the free or designated zones, then IP Business can retain contractors in the mainland and independent contractors abroad for this. According to Art. 4(2) of the Ministerial Decision, 'Qualifying Expenditures' means ‘expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person in the State or any Person outside the State that is not a Related Party, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property’.

Acquisition costs

Article 4(2) of Decision No. 265 is not clear on whether Qualifying Expenditures includes acquisition costs.

Para (a) of this Article doesn’t mention acquisition costs but refers to ‘expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person in the State or any Person outside the State that is not a Related Party, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property’. It doesn’t give a clear answer to the question of whether or not a purchase of IP assets, i.e. results of R&D) performed by any Person within the State or an unrelated foreign Person is a component of expenditures ‘directly connected with the creation, invention or significant development of the Qualifying Intellectual Property’. If it is, acquisition costs fit the definition of the Qualifying Expenditure.

Para (b) of the same Article sets forth that ‘Overall Expenditures’ means ‘total expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property, including acquisition costs of the Qualifying Intellectual Property’.

This doesn’t only clarify that Overall Expenditures comprise acquisition costs but it also answers the earlier question: do acquisition costs form part of the composition of the expenditures that are ‘directly connected with the creation, invention or significant development of the Qualifying Intellectual Property’. Yes, they do. Having established this, we may extend para (a) as follows:

'Qualifying Expenditures' means expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person in the State or any Person outside the State that is not a Related Party, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property + , including acquisition costs of the Qualifying Intellectual Property’. Such addition complies with para (b) cited above.

With this in mind, we have to reckon with the Ministerial declaration to implement the nexus approach developed within the OECD. The OECD in para 40 of the earlier mentioned Report disqualified such expenditures as: ‘interest payments, building costs, acquisition costs, or any costs that could not be directly linked to a specific IP asset’. Para 42 the Report elucidates:

-

‘taxpayer incurred all relevant expenditures itself, the ratio would allow 100% of the income from the IP asset to benefit from the preferential regime. This means that overall expenditures must be the sum of all expenditures that would count as qualifying expenditures if they were undertaken by the taxpayer itself.

-

This in turn means that any expenditures that would not be included in qualifying expenditures even if incurred by the taxpayer itself (e.g. interest payments, building costs, and other costs that do not represent actual R&D activities) cannot be included in overall expenditures and hence do not affect the amount of income that may benefit from an IP regime.

-

IP acquisition costs are an exception, since they are included in overall expenditures and not in qualifying expenditures. Their exclusion is consistent with the principle of what is included in overall expenditures, however, because they are a proxy for expenditures incurred by a non-qualifying taxpayer.

-

Overall expenditures therefore include all qualifying expenditures, acquisition costs, and expenditures for outsourcing that do not count as qualifying expenditures.’

To implement it, for instance, QatarQatar Ministerial Decision No. 20 of 17 Oct. 2021 On the Application of the Core Activity Requirements on Economic Activities Practiced in the State of Qatar.

excludes acquisition costs with a specific rule: ‘The following expenses and costs shall not be considered as Eligible Expenses: … Costs of acquiring intellectual property assets, including those incurred to obtain research rights, royalties and fees paid for licensing the use of an intellectual property asset’.

The UAE, on the other hand, did not include the rule with such an exception in Decision No. 265. Moreover, the wording used by the MoF gives rationale to justify the inclusion of acquisition costs in the amount of Qualifying Expenditure. Further Guidance or changes will show whether this has been done intentionally or by mistake.

Embedded IP

What is really cool is that: ‘Overall Income’ means royalties or any other income derived from Qualifying Intellectual Property as determined according to the provisions of the Corporate Tax Law, including embedded intellectual property income derived from the sale of products and the use of processes directly related to the Qualifying Intellectual Property as determined in accordance with the arm’s length principle under Article (34) of the Corporate Tax Law’Art. 4(2)(c) of the Decision No. 265.

.

This means that taxpayers:

-

may exclude income generated from other non-qualifying activity (for example, distribution outsideNot in and not from.

of the designated zone), income corresponding to the use of Qualifying IP assets in manufacturing, sale/resale, providing services or works, etc.; and -

must do so in cases where income from IP is included in other income generated by Qualifying Activity.

Let’s see where this leads.

Patent and other Qualifying IP are to be excluded from other Qualifying Activity and zero-rated within the cost-nexus limit

Under ESR regulations, embedded IP is not to be treated separately from the activity in which it used. Here’s what the MoF said in its Relevant Activity GuidanceSchedule to Ministerial Decision No. 100 of 19 August 2020.

:

‘Most UAE businesses will own some form of Intellectual Property Asset (e.g. their trademark, technical know-how relating to their processes, copyright in their works etc.), but not earn separately identifiable income from such assets. Instead, the Intellectual Property Assets contribute to or protect the value of the goods or services these UAE businesses provide. The ownership of such Intellectual Property Asset would not be considered as carrying on an Intellectual Property Business as the Intellectual Property Asset is merely auxiliary to the main business of the UAE business.

If there is any indication that a Licensee has manipulated its gross income to avoid being subject to the economic substance requirements as an Intellectual Property Business, for example by disguising royalties as part of sales income, the Regulatory Authority shall take the necessary action to ensure compliance with the ESR Regulations’.

The Example from the Minister is here:

ChocolateCo has a trademarked range of chocolates, which it manufactures and sells to unrelated third parties. ChocolateCo is not an Intellectual Property Business as its gross income is derived from the sale of finished goods to third parties, not the exploitation of an Intellectual Property Asset (i.e. the value of the trademark is intrinsically linked to the value of the chocolates and is not separately distinguishable, making the use of the trademark incidental).

Now, let’s replace trademarks in this example with patents which ChocolateCo holds for the recipes of its product and for the technology used to produce it. Let’s consider 2 options: one is where qualifying manufacturing is arranged in a free zone, while the second is where non-qualifying services have been provided in or from a free zone.

Option 1. Where principal activity is Qualifying.

Being guided by Art. 4(2)(c) of Decision No. 265, ChocolateCo has to determine using the arm’s length rules the part of the value brought by the patent holding.

Let’s say the price of one unit is 100 AED. If ChocolateCo had no patent rights, it would have to pay to the independent patent holder 7% of its revenues. Therefore, for ChocolateCo, 93 AED comes from manufacturing and distributionSee details on allocation of profit betweem manufacturing and distribution here.

activity and 7 AED ensued from embedded Qualifying IP.

The nexus ratio for this IP item is 0.6, i.e. Qualifying Expenditures with the Up-lift added contributes 60% to Overall Expenditures. Therefore, the 0% Corporate Tax rate may be applied only to 4.2 AED of Overall Income from the embedded Qualifying IP. The remaining 2.8 AED:

-

‘shall be considered Taxable Income and taxed’ at a 9% rate,Cabinet Decision No. 100 of 25 October 2023, Art. 7(2).

-

‘shall not be included in the calculation of non-qualifying Revenue and total Revenue’ for the purpose of the de minimis requirements.Ibid, Art. 4(3)(c).

Option 2 with non-Qualifying Services

A Company registered in a free zone holds patents for inventions used to support the production of low-permeable oil, hydraulic fracturing technology and horizontal drilling. It uses this to provide oilfield services to the number of clients. This activity is not included in the list of Qualifying Activities.

Embedded IP measured using the arm’s length rules contributes 20% of the Company’s revenues. This IP has been developed abroad under the Company’s supervision by independent providers. All expenditures are Qualifying, i.e. the nexus ratio is 1.0.

However, the Company still may not enjoy the 0% Corporate Tax rate due to de minimis requirement. 80% of its total revenue represents non-Qualifying activity. This deprives the Company of an opportunity to the use 0% rate for this period and the subsequent 4 years.Decision No. 265, Art. 5(2).

Shall IP income be singled out to reduce income from Qualifying Activity?

This new tool is prescribed for embedded Qualifying IP, e.g. a patent used to manufacture the product. However, it may also expose the taxpayers with embedded non-qualifying IP, for instance a trademark put on a manufactured product.

Indeed, Art. 4(2)(c) of Decision No. 265 stipulates that ‘Overall Income’ means royalties or any other income derived from Qualifying Intellectual Property as determined according to the provisions of the Corporate Tax Law, including embedded intellectual property income derived from the sale of products and the use of processes directly related to the Qualifying Intellectual Property as determined in accordance with the arm’s length principle under Article (34) of the Corporate Tax Law’. This wording doesn’t present the scenario with embedded IP as an exception to all other cases with embedded IP. Rather, it shows that embedded intellectual property income is always included in income derived from any intellectual property.

Earlier in the public consultation preceding the changes at hand, the Ministry promoted a concept which opposes such approach. That is what the MoF discussed in the digital consultation:

4.5 Article 3(1)(f) – Ownership or exploitation of intellectual property (IP) assets; Scope

The ownership or exploitation of intellectual property assets means activities that generate separately identifiable income from intellectual property assets ...

The reference to “separately identifiable” income means that income such as royalties, licence fees, capital gains and other income that is directly attributed to the intellectual property assets would be considered income from an Excluded Activity.

On the other hand, income derived from the use of intellectual property assets that is used in or otherwise contributes to a product or service for which no separate remuneration is received should generally not generate income from the ownership or exploitation of the Free Zone CT regime.

Illustrations…

(2) A manufacturer in a free zone produces and sells branded goods to its customers. The value of the branded goods includes ‘embedded IP’ (i.e. the sales price intrinsically includes a value associated with the ‘brand’ which cannot be separately determined). Given no separately identifiable income from intellectual property assets is earned in this scenario, the manufacturer may benefit from the Free Zone CT regime where it meets the conditions of undertaking the Qualifying Activities of “manufacturing: and “distribution”.

Now, we may see that this approach is subject to potential change. Let’s elaborate this potential with an example the MoF gave earlier.

Example from Digital Consultation adjusted to actual change in the regulations

Being granted by an independent party, the trademark used in branded goods would cost the Manufacturer 10% of the revenues.

Therefore, 90% of the revenues may be related only to the manufacturing activity. 10% falls to non-Qualifying IP. This part is subject to the 9% Corporate Tax rate. Fortunately, this disqualified part doesn’t affect the de minimis calculation and the Company may keep the opportunity to apply 0% for 90% of its income.

Does IP Business really needs 2 economic substance regulation?

Let me ask this question at the end. IP Business now is partially to be treated with 0% Corporate Tax rate. This rate will be applied only to the activity localized in the UAE, i.e. an income correspondent to an activity with no substantial nexus with the State is under the general 9% rate. So as, income gained from non-Qualifying IP assets.

Let’s take Qatar for example as it has adopted similar nexus ratio approach.

In Qatar, Corporate tax is set at 10%Qatar Law of 13 of December 2018 No. 24/2018 (Income Tax Law), Art. 9.

. It is not applicable to income from sources located outside Qatar. However, Article 2 bis 1 of the Corporate Tax Law determines that royalties earned abroad and paid to a resident of Qatar are considered as income from a source in Qatar, if they were not received as a result of the activities of a foreign permanent establishment. Thus, as a rule, royalties in Qatar are to be taxed at a rate of 10%.

There are economic substance rules (ESR) in QatarQatar Ministerial Decision No. 20/2021 On the Application of the Core Activity Requirements on Economic Activities Practiced in the State of Qatar.

. For IP business, they prescribe to determine the R&D costs incurred in Qatar and for independent providers outside of it.[2] Similar to the UAE now. Only the amount of profit attributable to them passes the ESR testArt. 1 Decision № 20/2021.

.

However, the ESR in Qatar is applicable only in cases where the taxpayer enjoys tax benefits that do not fall under the general taxation regime: ‘… any Eligible Entity that engages in one or more Covered Services Activities may benefit from a Preferential Tax System if it meets the required conditions for the same, provided that such entity undertakes the Basic Income Generating Activities benefiting from that system’.Ibid, Art. 3.

Preferential tax system determined for that in Art. 1 as ‘any system that offers a tax advantage compared to the general principles of income tax in the State, regardless of the form or amount of the advantage’.

The rule on taxation of income obtained only from sources in Qatar with a 10% tax rate is a general principle, not a special benefit. So, Qatar:

-

doesn’t burden its taxpayers with ESR at all where general taxation is applicable, and

-

burden them only once with ESR compliance (with nexus approach only) where the UAE require compliance with both: nexus approach substance (to apply 0% rate) and regular ESR substance (just for a substance itself).

Why not to follow Qatar as best practice? I don’t know.

Disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law.

See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have status of the author’s opinion only. Like any human job, it may contain inaccuracy and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.